Nature provides services worth over $125 trillion per year globally

The planet’s species population sizes have decreased by 70% since the 1970s. Yet while scientists have proven that biodiversity loss is intimately linked with climate change, it continues to be kept in the shadows of the climate agenda

As the Nature-based Solutions Conference kicks off at Oxford University this week, we speak to Professor Nathalie Seddon about why boosting biodiversity is essential to building the resilience of our ecosystems in a warming world – and why planting trees is not the catch-all solution some think it is.

LUX: The mass of living creatures in the world is undergoing a dramatic diminution. What are the effects of this?

Professor Nathalie Seddon

Nathalie Seddon: The statistics are startling. We have lost about 80% of wild fish from the oceans and 82% of wild mammals on land, so our habitats and natural ecosystems are basically empty. 97% of vertebrates on the planet are people and their livestock; only 3% are wild creatures that we share the planet with. 9 million hectares of tropical forest are cut down a year; and we’ve modified over 50% of land use.

Biodiversity is important for multiple reasons – material, cultural and spiritual. Our health is intimately linked to the health of all these ecosystems that we are currently destroying. Our nature systems support us in countless ways, providing clean air, water, food, and genetic resources. Over half of GDP depends on natural ecosystems, which generate over $125 trillion worth of ecosystem services each year – from reducing the impacts of droughts and protecting coastlines from flooding or forests from wildfires. These services are dependent on the species and the diversity of the species within them, and are incredibly important to our resilience in a warming world.

Follow LUX on Instagram: luxthemagazine

LUX: Why is there so little awareness around biodiversity loss?

NS: Climate still doesn’t get enough attention or funding, but it is considerably more prominent in discourse than biodiversity is. Our economy has also been developed on the assumption that nature’s resources are infinite. People assume that, with enough money, technology will come to the rescue. I think there is a fundamental reason to explain all of these: the age-old idea that humans are not part of nature but rather separate from it; that we must conquer nature rather than flourish as a part of it. This disconnect between humans and nature is the root cause, and therefore also part of the solution to the trouble we face.

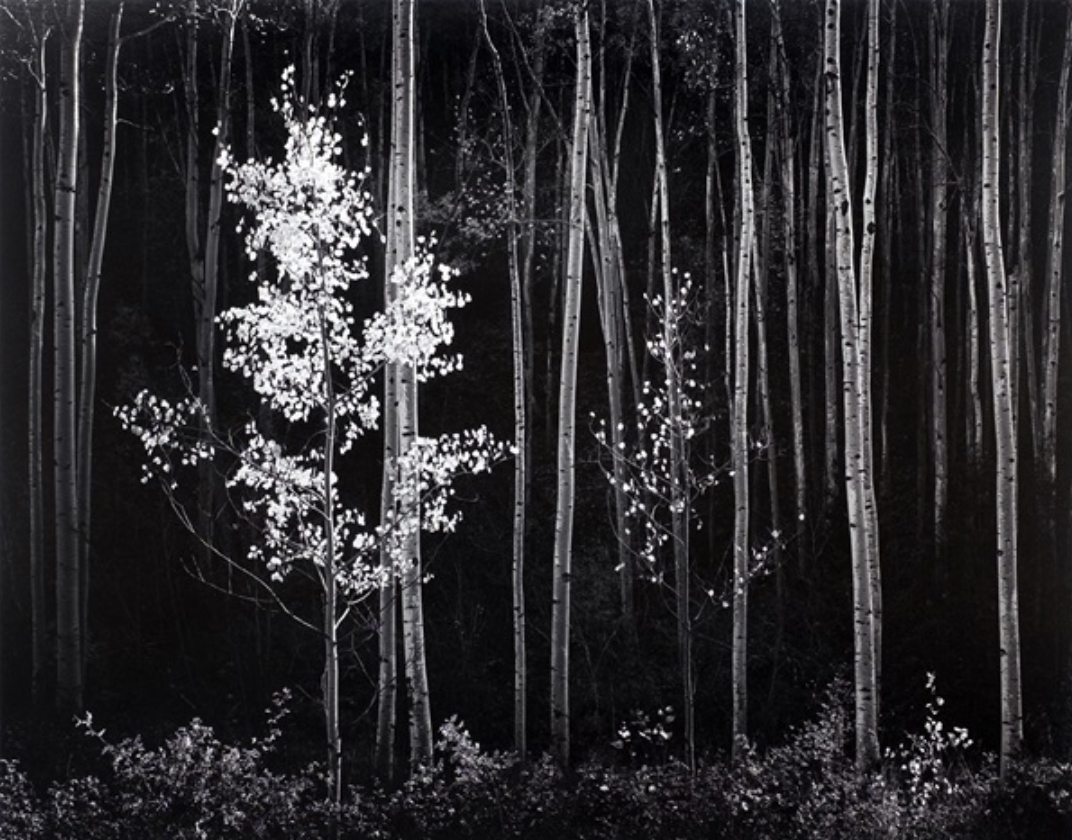

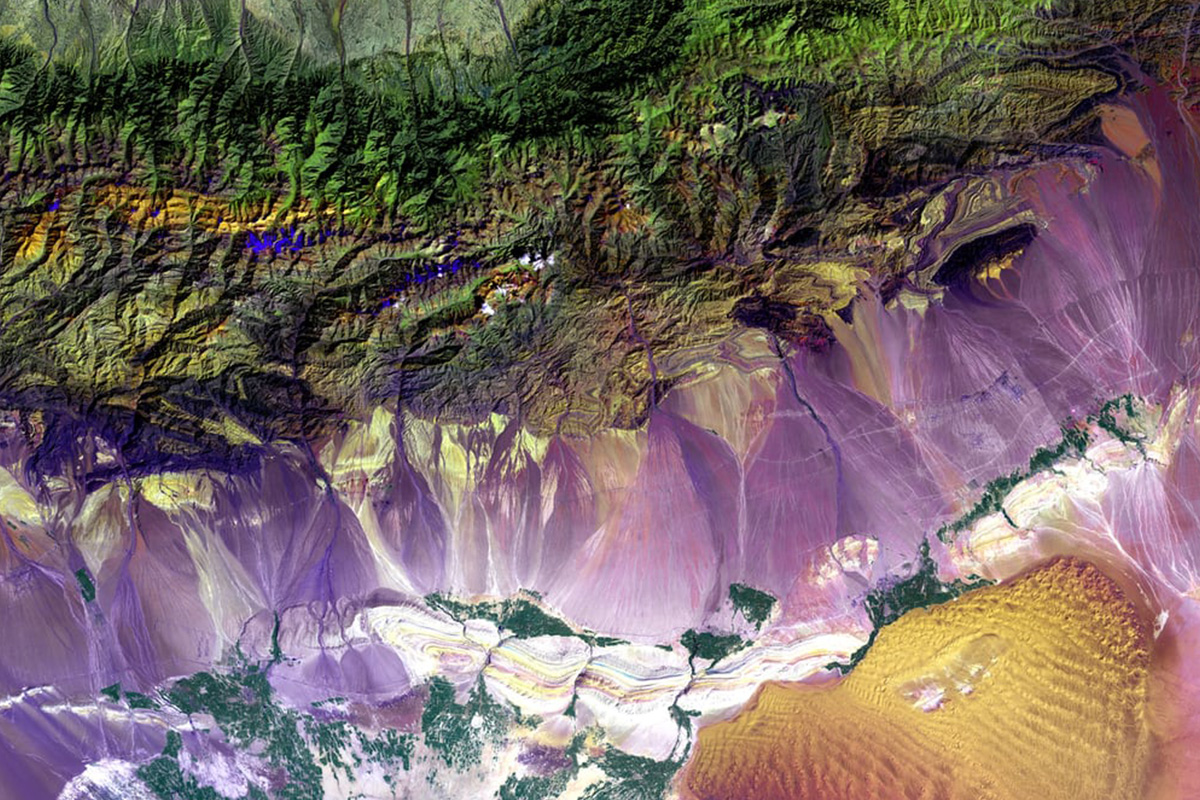

Deforestation contributes to increases in temperatures and changes in rainfall patterns across the world

LUX: Are we at a turning point of the understanding of the importance of biodiversity – not just as a desirable end in itself but as an essential part of combating climate change?

NS: In principle, yes. In the international policy and business community, there’s a lot more talk about biodiversity and climate change as two sides of the same coin. But a lot more work is needed to make sure that there is a robust understanding of what that means in practice and how that translates on the ground. For instance, agriculture or commodity production are the biggest drivers of biodiversity loss and also the second biggest source of greenhouse gas emissions. Protecting and restoring our biodiversity can help reduce emissions, but about 23% of our emissions come from changes in the land use sector in agricultural and forestry and other land use, so improving what happens in those landscapes can also have important impacts on warming. It’s only still quite a small part of the solution.

There has been a step up in terms of the prominence and emphasis on nature as part of the negotiations on nature-based solutions. But there are huge misunderstandings, including a big conflation of commercial forestry with nature-based solutions. You can’t just plant trees and then delay decarbonisation and transition to renewables.

The Glasgow Science Centre played a key role in last year’s COP26 discussions

LUX: What are the most important steps leaders in business and wealthy individuals can take to combating this?

NS: A lot of businesses and governments are making net zero pledges, covering 90% of the global economy. But you look under the bonnet, and most of them are not underpinned by a really robust science based plan or any funding to enact it.

Talking about how nature, biodiversity and climate are connected is good, but we need to ensure that decision makers who are acting on that basis understand what that actually means in practice.That doesn’t mean offsetting carbon emissions by investing in cheap forestry plantations. It means doing everything they possibly can to reduce those emissions and reduce the damage that they’re doing to ecosystems within their supply chains whilst also investing in projects that are biodiversity based and community led and ideally doing that within their supply chains, which is a process that’s called insetting rather than offsetting.

Read more: Cary Fowler on Protecting the Biodiversity of our Planet

Offsetting is when a company will calculate its impact on climate or emissions so it will invest in probably some trees somewhere that probably shouldn’t be there and feel like it is addressing the problem. Insetting is looking within your own supply chain and investing in high quality, valuable projects within that supply chain, so insetting your damage to the biosphere and the climate within your supply chain. In doing so, you are not only meeting your ESG requirements but also increasing the value in resilience of the supply chain itself. It’s about investing in nature in your supply chains to reduce risk, operational risk, supply chain risks as well as reputational risk.

There is a real need to engage fully with the research community to ensure that those pledges can be met in a sustainable, ethical, biodiversity community-based way and so that’s where the work is. Public-private partnerships between researchers and businesses are really important. Companies in general should adopt a generative, circular economy model and then embed proper robust accounting on natural and social capital in their accounting procedures.

Humans have identified just 3 million of over 12 million complex life forms on the planet

LUX: Is it true that we are still discovering exactly how different species, seemingly unrelated, can have a dramatic impact on the health of the planet and the human race?

NS: There’s upwards of about 12 million complex life forms on the planet, and we have only named around 3 million of them. We don’t know what functions all those species play in the ecosystem, we just know that all species matter and that we can’t afford to lose the predicted 1 million species by the end of the century.

That diversity gives ecosystems the resilience they need in a warming world. It’s like having a diverse investment portfolio – the more different sorts of investments you have, the more likely it is to be able to weather the storm, in that case, a financial storm. In a natural world, the more species you have, the more likely it is that that ecosystem can deal with whatever is coming.

LUX: Are there any causes for hope, or is your feeling that we are doing too little too late?

NS: On one hand it’s all very frustrating because we’ve known for a very long time what causes climate change and what drives biodiversity loss, yet very little has been achieved. Put it into perspective: we have lost about 70% of species populations since the 1970s, despite a huge increase in the coverage of protecting it.

But there are lots of countries that are pledging to do the right thing: community and biodiversity based investments and nature-based solutions, at the same time as big commitments to renewables and reducing emissions. Costa Rica is leading on climate policy and the practice of renewables, plus large areas of land are under recovery and protection. [The same goes for] Moldova, Brazil, Chile and Cape Verde, at least on paper, in terms of how they’re incorporating nature into their climate change pledges.

There are also various companies that are taking a high integrity approach to tackling net zero. Netflix is an example of that: they are reducing emissions across all of their operations as fast as they can, as well as investing in projects that are truly verified in terms of their carbon, biodiversity and social benefits. That’s the real point. You can’t invest in nature if you’re not also doing everything you possibly can to reduce emissions.

Nature-based solutions involve the sustainable management and use of natural resources to tackle socio-environmental challenges

LUX: Who are the laggards?

NS: Most of the main fossil fuel companies are talking about decarbonisation but they’re not making enough progress. We need to keep fossil fuels in the ground and we need to invest in nature. It’s not ‘either or’, and some of those big fossil fuel companies are just greenwashing their operations by claiming to invest in so called nature-based solutions which often just turn out to be short rotation commercial forestry plantations. That’s a live issue that needs to be fully addressed.

At the government level, many countries are investing in tree planting, while not ensuring that their existing biodiversity and intact ecosystems are protected properly, and in fact actively opening them up. Decisionmakers seem to think that growing a tree is the same as a tree which is in an intact ecosystem, yet science is really clear that there is no equivalent: you can’t recapture the carbon lost through destroying our intact ecosystem in a timely or sensible way through planting trees. .

Read more: Julie Packard: All In Together

LUX: How would you explain to an intelligent but distracted business leader that the loss of a seemingly trivial habitat in one part of the world can have a fundamental effect on people in the other?

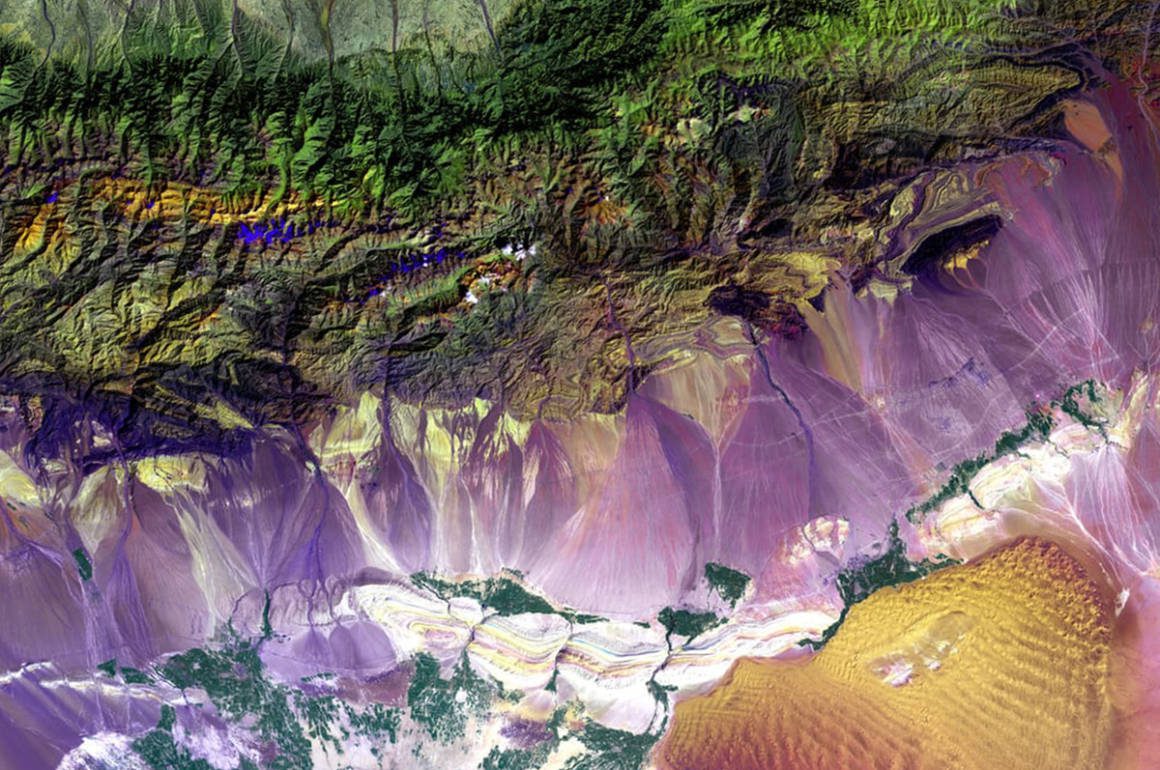

NS: The earth is a big, interconnected system. Deforestation rates in the Amazon are increasing to meet global demand for beef and soya, but because Amazonia is a big water pump, this can cause changes in global patterns of rainfall, therefore compromising food security and causing supply chain issues. For the intelligent but distracted business leader who thinks that it doesn’t really matter if we lose all the monkeys or toucans from a forest, it does, because those species play a critical role in the ecosystems and we need to extract carbon from the atmosphere to keep all of us safe.

Ultimately, we need systemic change in how we run our economies. Our economic system prioritises material wealth and infinite growth on finite resources. Unless that changes, we won’t avert climate change and biodiversity. We need to think about circular and regenerative economies, and we as individuals need to enact big behavioural change as part of that. Otherwise, you’re just rearranging chairs on the Titanic.

Nathalie Seddon is Professor of Biodiversity in the Department of Zoology at the University of Oxford.

Find out more: naturebasedsolutionsoxford.org

Can we put a price tag on nature? Valuing the carbon services of plants and animals is essential to bridging the gap between finance and conservation, says Professor Connel Fullenkamp, the leading academic working at the intersection of science and economics. Here, Fullenkamp speaks to LUX about the importance of engaging capital markets in biodiversity financing, and why necessity is the mother of invention

Can we put a price tag on nature? Valuing the carbon services of plants and animals is essential to bridging the gap between finance and conservation, says Professor Connel Fullenkamp, the leading academic working at the intersection of science and economics. Here, Fullenkamp speaks to LUX about the importance of engaging capital markets in biodiversity financing, and why necessity is the mother of invention

Jennifer Anderson, Co-Head of Sustainable Investment & ESG at Lazard Asset Management, speaks to LUX Contributing Editor, Samantha Welsh, about the history of her career, the changes in the ESG investment landscape over that time, and offers an insight into why she thinks the industry is at an important inflection point

Jennifer Anderson, Co-Head of Sustainable Investment & ESG at Lazard Asset Management, speaks to LUX Contributing Editor, Samantha Welsh, about the history of her career, the changes in the ESG investment landscape over that time, and offers an insight into why she thinks the industry is at an important inflection point