Auctioneer Oliver Barker directing Sotheby’s global e-auctions. Courtesy of Sotheby’s.

As part on an ongoing monthly column for LUX, artnet’s Vice President of Strategic Partnerships Sophie Neuendorf forecasts this year’s emerging trends and evolutions in the art world

Sophie Neuendorf

We’ve just emerged from arguably the most difficult and unpredictable year in recent history. The Covid-19 pandemic caused a synchronised and deep downturn of the global economy in the first six months of 2020. Social distancing measures and a lockdown of businesses in reaction to the health crisis resulted in falling consumer demand and economic output. Skyrocketing unemployment shook consumer confidence, and companies cut back on investments in light of declining demand, supply-chain interruptions and the uncertain future.

Follow LUX on Instagram: luxthemagazine

Amid the uncertainties and restrictions caused by the pandemic, fine art auctions plummeted in the first half of 2020. Total sales value dropped across all major regions. According to the artnet Price Database, global auction sales for fine art fell by 59% to $2.9 billion in the first half of 2020 compared to a more robust performance of $7 billion in the first six months of 2019.

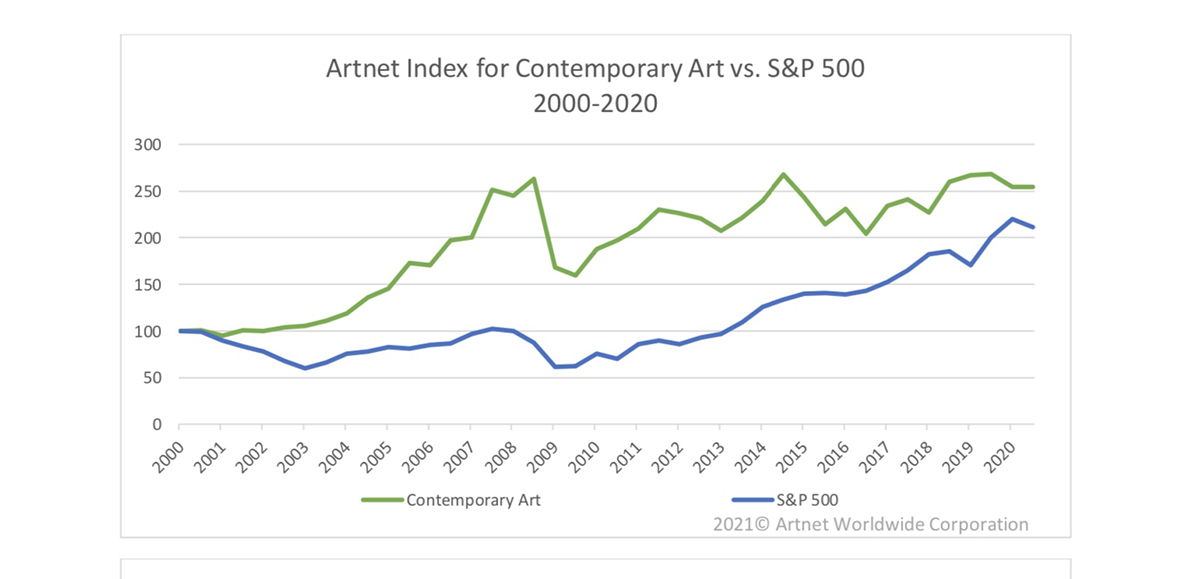

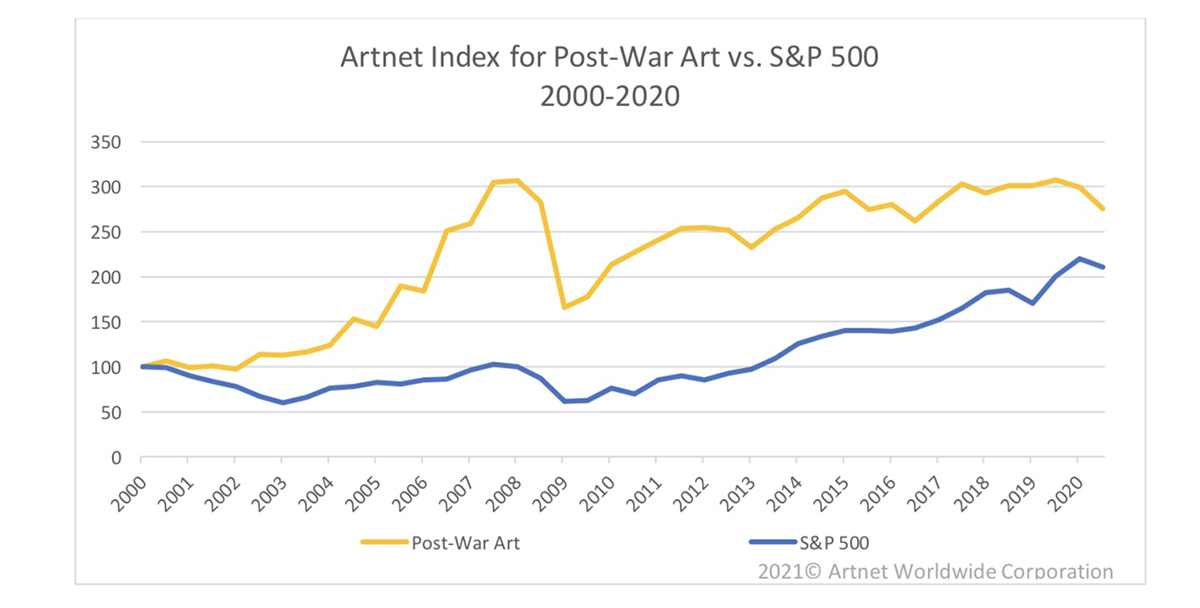

Infographic courtesy of artnet

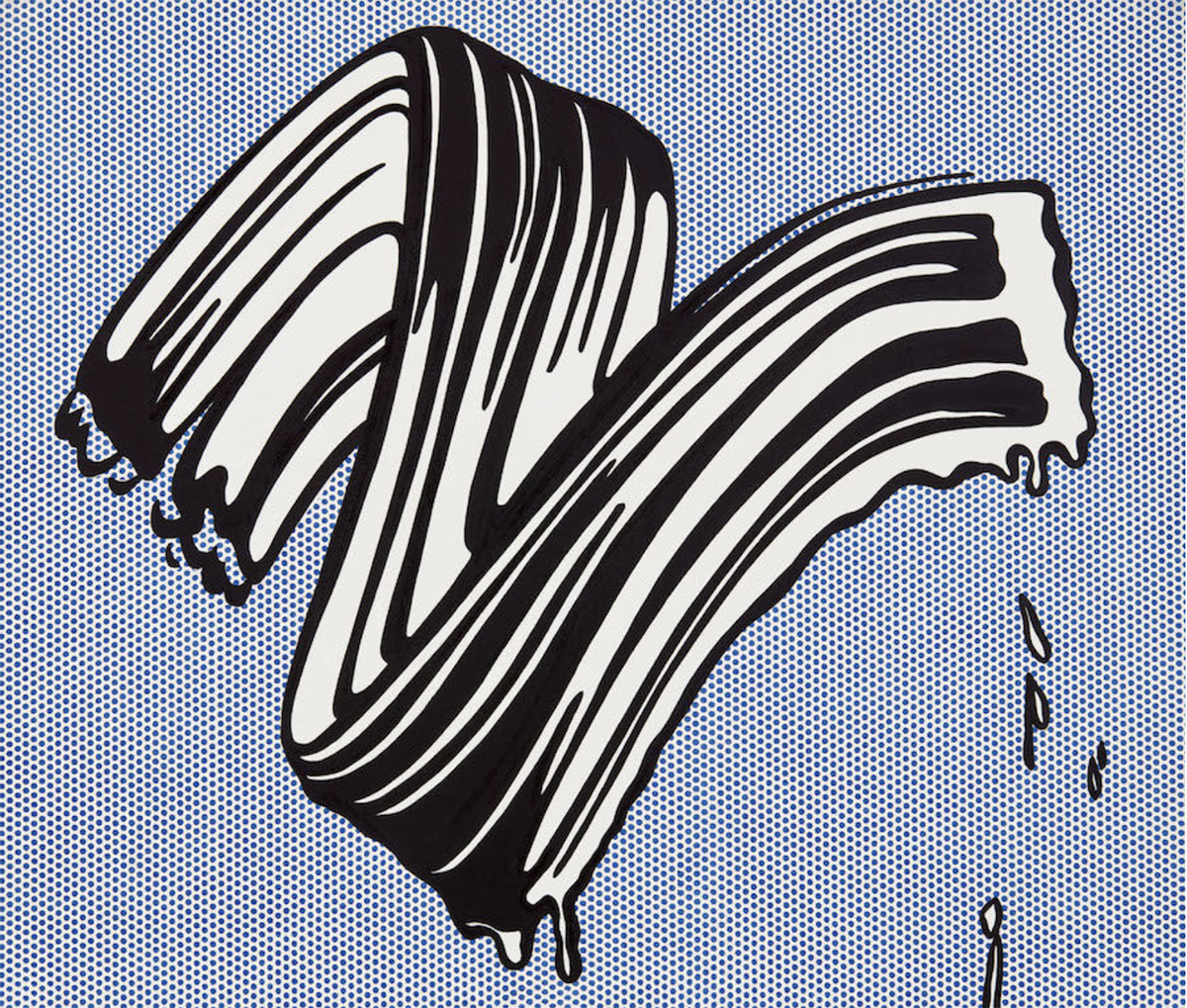

However, despite a 29% decrease in both the number of lots offered and sold at auction year-over-year, the global sell-through rate remained steady at 65% in the first half of 2020. Major auction houses pivoted to online platforms, generating some incredible virtual transactions. In June, Sotheby’s sold Francis Bacon’s Triptych Inspired by the Oresteia of Aeschylus (1981) for $85 million. Roy Lichtenstein’s White Brushstroke I (1965) achieved $25 million.

Even though 2020 will most likely be remembered as one of the most unpredictable and difficult years in modern history, it also pushed boundaries and accelerated the art world into the digital age. With this backdrop in mind, I’m going to take the risk and make 7 art world predictions for the year 2021 – because, if anything, last year has set the stage for some ground-breaking changes to aspire to.

1. Digitalisation is here to stay.

Plato was right: necessity is indeed the mother of invention. During the COVID-19 crisis, one area that has seen tremendous growth is digitalisation, meaning everything from online customer service to remote working to supply-chain reinvention to the use of artificial intelligence (AI) and machine learning to improve the art business. As I discussed in my last column of 2020, the digitalisation of the art market is here to stay. With galleries, museums, and auction houses pivoting online and thinking outside the box in response to the pandemic, a positive trend of accessibility, efficiency, and transparency accelerated within the art world. This also goes hand in hand with a global trend of sustainability and conscious living.

Naturally, an online viewing of art can never quite replace the in-person experience, nor should it. The impact of seeing Da Vinci’s Mona Lisa online is, of course, not quite the same as admiring it in person. However, the transactional element of the art market will emerge as a strong contender to the traditional brick and mortar purchasing process, democratising the art market and opening it up to a new generation of art lovers.

2. Some art fairs will actually happen this year. But they will be a balanced, online/offline experience.

With social distancing still de rigueur this year, it will be difficult for fairs to accommodate their usual amount of art-loving and people-watching visitors. Add to that a gallery’s sky high participation costs, especially after a difficult year, and we’re looking at only very few fairs happening in 2021. My conservative prediction is that those of us able to travel can look forward to visiting ARCO Madrid (which has been postponed to July), Art Basel in Basel, Volta Basel, Frieze London, FIAC Paris, and Basel Miami, at best. The rest of us will have to enjoy the virtual editions of these fairs again this year.

Read more: COMO Group CEO Olivier Jolivet on travel trends for 2021

3. Galleries will evolve as serious contenders to art fairs and traditional auction houses.

Gallerists have always been of utmost importance as a bridge between the creative genius of an artist and the wider public of art lovers and collectors.

This year, galleries who have embraced the innovation which the Covid-19 pandemic necessitated will emerge stronger than ever. Either through online sales and viewing rooms or through collaborations with other galleries and institutions, these art dealers will rise as serious contenders to brick-and-mortar auction houses.

4. Some young artists will start bypassing galleries and begin selling directly out of their studio via social media or other websites.

It’s already a widespread practice among young artists in Asia and I foresee it crossing over to Europe and the US this year. With countless galleries, unfortunately, having been forced to close over the last year, many artists may have become increasingly accustomed to selling via social media and other websites. Especially young artists may be inclined to bypass the traditional route expected of them by the art world, and chose to build their careers independently.

Roy Lichtenstein’s White Brushstroke I (1965) was sold by Sotheby’s for $25 million. Image courtesy Sotheby’s

5. Socio-economic issues will be at the forefront of major gallery and museum shows this year.

Artists have, historically, documented moments of change and upheaval. After a year that has compelled us to come to terms with a global pandemic, has seen us fight for equality during the Me Too and BLM movements, as well as confront global warming, now’s the time to examine these pivotal moments within gallery and museum shows.

The arts are known to push boundaries and open up discussions around difficult and oftentimes painful subjects in a spirit of tolerance, curiosity, and learning. I believe that galleries and institutions will harness this unique moment to exhibit artists who are capturing the zeitgeist.

Francis Bacon’s Triptych Inspired by the Oresteia of Aeschylus (1981) was sold for $85 million at auction by Sotheby’s in June 2020. Image courtesy of Sotheby’s.

6. There will be more fine art works sold at auction this year than over the last few years.

Given the global economic and private difficulties we are currently facing, it wouldn’t be surprising if the IRS, a divorce attorney or the grim reaper force the sale of many a private collection. It’s a rather gruesome prediction, but historically the art market has been very active during a time when some micro or macro-economic situations are under stress.

Looking at Deloitte’s Art & Finance report or artnet’s Intelligence Report, fine art has gradually emerged into a serious asset class. When you compare fine art sales to the S&P, for example, more often than not it is art which is a safer alternative asset than stocks or even real estate. It is highly likely that many artworks will find speculative buyers this year, as economic changes and challenges will cause a shift in wealth.

Read more: Visual artist Clara Hastrup on her studio experiments

7. There will be a major shift in the market resulting in a new focus on quality rather than quantity.

Life was moving along as rapidly and frivolously as usual during the months before the Covid-19 pandemic forced us into seclusion. It struck me even then that the art world was moving into an unhealthy direction, where being seen at a champagne reception was more important than the quality of work on display. Where people-watching at Frieze or Basel was far more interesting than any oeuvre, and gossiping about people or prices trumped any serious deliberations of the works on view.

However, the past year has forced all of us to focus on what’s truly meaningful within our lives and on how fleeting it actually is. How do we really want to spend our time? Do we actually have to visit all of those art fairs and events? Perhaps we should seize the moment and focus on those artists and personal interactions that really enrich our lives.

This may seem like a rather wild prediction, but I’m certain that only those galleries, fairs, and institutions will survive that really concentrate on bringing added value to our lives. Perhaps we will move to a ‘new normal’ where multiple editions of the same fair or gallery are unnecessary, but are, instead, complimented by an incredible and easy to access online offering. Now is the time to excite with quality, depth, and innovation – because time is precious.

Infographic courtesy of artnet

8. Art will not only evolve as an asset class, but also as a financial product.

Over the past few years, art has slowly evolved as a serious contender to assets such as gold, stocks, or real estate – and it is arguably a much more stable asset. Given the high barriers to entry into the art market, specifically to the high-returns, blue chip market, I predict that there will be a derivative product developed soon, to be traded on the market similarly to other indices.

Price indices offer important insights for anyone looking to track the performance of a collection of artworks produced by a single artist or movement. At artnet, for example, we already provide an innovative price index methodology that relies on the unique strength of our flagship product, the Price Database. Our proprietary method creates indices that track the evolution of artwork prices over time, which can be tailored to focus on artworks belonging to a specific medium, movement, size, or any combination thereof, and in comparison to other indices, such as the S&P. It’s only a matter of time until the exchange traded derivative is developed. Stay tuned!

Follow Sophie Neuendorf on Instagram: @sophieneuendorf