Richard Curtis, the screenwriter and film director behind Notting Hill, Bridget Jones’s Diary, and Love Actually has launched a new campaign – to ensure people pressure their pension providers to follow sustainable principles. If successful, it could trigger a seismic shift in ESG investments. He speaks to Ella Johnson.

Richard Curtis is celebrated for comedic masterpieces like Four Weddings and a Funeral (1994) and Bridget Jones’s Diary (2001). Making nearly $300 million apiece at the box office, his Oscar-nominated films have starred everyone from Hugh Grant to Julia Roberts, Renée Zellweger to Colin Firth – to name but a few. Now, Curtis has launched a campaign aimed at ensuring fund managers put their money where their marketing material is on the green transition. For an industry worth $56 trillion globally, this would be a key pillar in achieving the Paris Climate Agreement goals.

It’s not the first time Curtis has turned his hand to social impact. He is the leader of Project Everyone, the not-for-profit creative communications agency raising awareness around the UN’s Global Goals. Following the 1985 famine in Ethiopia, Curtis also co-founded Comic Relief with actor and comedian Lenny Henry. Through its annual Red Nose Day comedy telethons in Britain, which have involved a star-studded roster of celebrities including Justin Bieber and the Duke of Cambridge, the charity has raised £1.3 billion for disadvantaged communities around the world. It also inspired the launch of a US edition in 2015, which names Jennifer Garner and Jack Black among its contributors and has raised $270 million to end child poverty to date.

Yet with trillions’ worth of pension schemes failing to commit to robust Net Zero targets, Curtis’ next venture could have an even greater (and greener) impact. According to him, it is all well and good spending your life fighting for great causes – but if your pension is funding precisely the opposite cause, what good are you really doing?

LUX: You describe people’s pension investments as a “superpower” hidden in plain sight. What does that mean?

Richard Curtis: It all changed for me when I saw a brilliant TED talk by an Australian cancer doctor called Bronwyn King, who discovered that a lot of her pension money was invested in tobacco companies without her knowing – meaning she’d actually been killing more people with her investments than she’d been saving with her life’s work.

The more I looked into it, the more examples of this I saw. From peace activists investing in weapons, to climate campaigners funding fossil fuel companies, to vegans investing in the meat industry – it was clear that many of us had become accidental investors in the practices we fight against.

LUX: What’s the key element of your campaign?

Richard Curtis: A key part of our campaign is to showcase what’s possible if we direct our money towards funding the best companies. Our 21x Campaign centres upon research conducted with Aviva and Route2, which found that moving from a default pension to a sustainable one could be 21 times more powerful at cutting your carbon footprint than giving up flying, becoming a vegetarian and switching energy provider combined.

Imagine if all £2.6 trillion in UK pensions was in sustainable funds; helping tackle the climate crisis, restore nature, alleviate poverty, provide affordable housing, and support medical research – the impact could be extraordinary.

Follow LUX on Instagram: luxthemagazine

LUX: Why is this awakening happening now?

Richard Curtis: I think we’re now at an incredibly exciting moment in civic activism. People are no longer waiting on others to change the world for them – they’re taking matters into their own hands and asking ‘what can I actually do to make a difference with my everyday actions?’ They are finding answers in unexpected places: in the clothes they wear, the food they eat, and how they travel. They’re discovering it in the products they buy, the brands they engage with, and the employers they work for.

Left to right: Bill Nighy, Rachel McAdams, Richard Curtis and Domhnall Gleeson arriving for the About Time UK Premiere held at Somerset House, London, 2013

LUX: Does following ESG guidance mean lower returns?

Richard Curtis: Research has shown that investing in sustainable, long-term businesses can have a positive impact on the environment and on society, and still secure healthy returns.

Morningstar examined the performance of 745 Europe-based sustainable funds and found that the majority of them had done better than non-sustainable funds over one, three, five and 10 years. In fact, many industry leaders have called the green transition the greatest economic opportunity of a generation.

We’re entering a time where it doesn’t have to be values vs. value, money vs. morals; you really can have both.

LUX: How are you raising these issues to the top of the agenda for the young generation?

Richard Curtis: Our first job is to get this issue on the radar of businesses leaders and CEOs – making sure that pensions are the new frontier for sustainability minded organisations across. After all, why serve vegetarian meals in the canteen if your pensions are invested in factory farming? Why install renewable energy across your offices, but continue to invest in coal? And why build a world beating sustainability plan if your pension money is directly undermining those actions?

This is a huge gap, but more importantly an enormous opportunity for impact. With customers, shareholders, investors, and employees increasingly asking businesses to ‘walk the talk’, authenticity and consistency across organisations’ climate change strategies can create a real competitive advantage, alongside real-world impact.

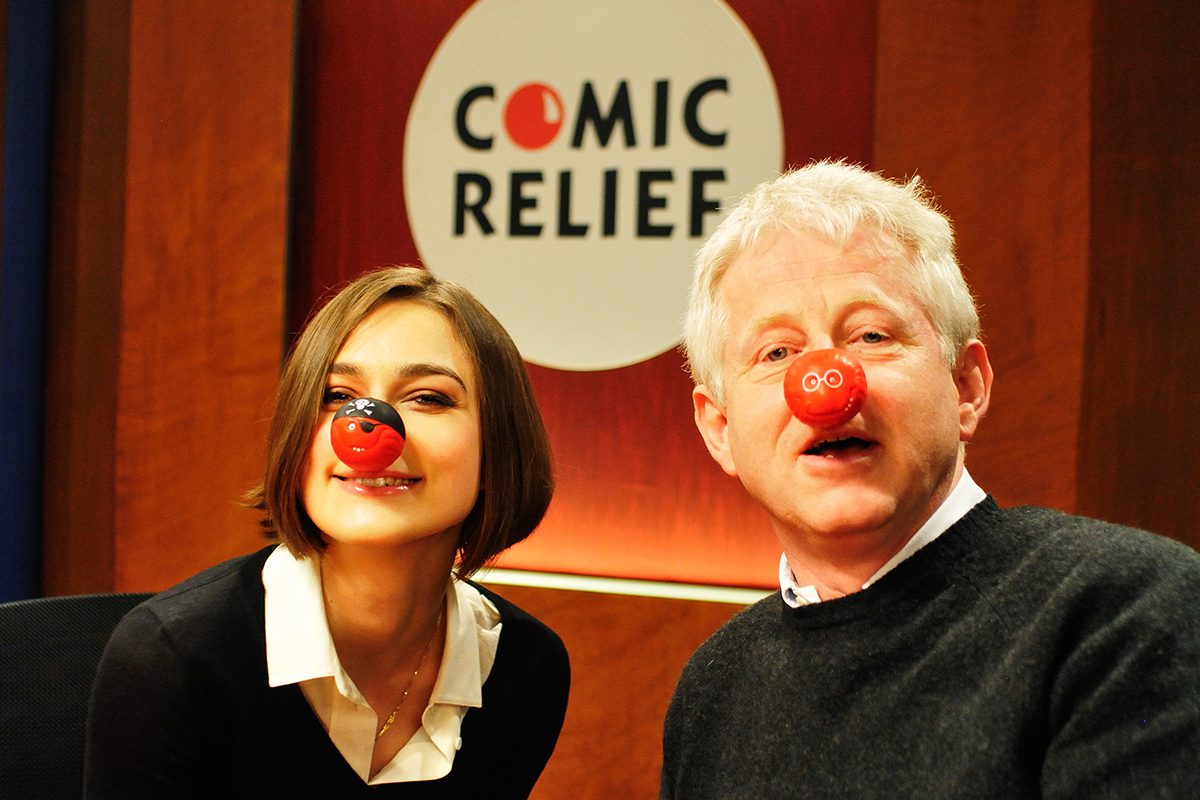

Richard Curtis and Keira Knightley for Comic Relief Red Nose Day

In putting their money where their mouth is, businesses can turbocharge their existing efforts in their race to net zero, engage new customers and clients, and help build a world fit for their employees’ retirement. All while protecting their investments from the worst effects of climate change.

Read more: Catherine Mallyon on The Royal Shakespeare Company’s Success

LUX: Your career has been dedicated to alleviating human suffering – through the £1.3 billion raised by Comic Relief to date; and now, through the £1 trillion worth of pension money that has been diverted towards tackling the climate crisis. How do you maintain clarity of vision and purpose on this scale?

Richard Curtis: Everything I’ve ever done has mainly been the work of so many other people. I’m the guy who opens the door for everyone else to come through. The real answer is that I sometimes do worry that I’m not doing the right things at the right time – but what I try to do is just work out where I, with my limited skills, can be most useful. And, when I find something like Make My Money Matter, I try to actually treat it like a proper job and spend my time making things, and organising events and campaigns – rather than just talking round things. My motto has always been ‘To make things happen, you have to make things.’

Find out more: www.makemymoneymatter.co.uk