Proper ceramic coating, after a thorough paintwork correction, is the only way to make your new car look properly new, as LUX discovers with its recently purchased high-performance convertible

Proper ceramic coating, after a thorough paintwork correction, is the only way to make your new car look properly new, as LUX discovers with its recently purchased high-performance convertible

When you’re choosing a new car, there are many questions to ponder. Electric, hybrid or petrol? (The eco-friendly answer requires some research in each case.) Which brand? Exterior colour, interior colour, options? Which wheels? Did you think about tyre brand (a whole other world)? Are there any extras that will help with resale? (The short answer: you won’t get the extra couple of thousand you pay for the head-up display or the carbon fibre steering wheel back, but the right options make it easier to sell).

Very few people ponder one fundamental issue. Your brand new car is likely to be delivered with paintwork that is scratched and pitted, and it will only get worse unless you do something about it.

This is not due to some plot by manufacturers. But whether you buy a Ferrari or a Cinquecento, a Tesla or a Lamborghini, from the point it is painted at the factory, your car will spend weeks or months being transported to you, during which point it will (hopefully) not receive any plainly-visible scratches or marks. But it will be wiped, cleaned, dried and “valeted” on various occasions, and those actions, done in a hurry with the best of intentions, leave swirls and scratches on your paint, clearly visible on close inspection. And without further protection, that will only get dramatically worse during your ownership.

That’s where a proper ceramic coat comes in. Ceramic coating is to old-fashioned polishing and waxing what an iPhone 12 is to a Nokia, and here LUX hands over to Ahmed Al-Wajih, director of 1080, who was responsible for the shine on our Mercedes C63S Cabriolet Brabus 600 in these photographs, courtesy of products by market-leader G-Techniq.

LUX: What happens to unprotected paint on a car under normal circumstances (without ceramic coating)?

Ahmed Al-Wajih: Unprotected paint is exposed to elements in our environment, such as oxidation from the sun, contamination from pollen tree sap and bird droppings. These can be very harmful to your vehicle’s paintwork if not addressed immediately and safely. An unprotected surface has a much faster wear rate than a protected surface.

LUX: Can you describe the science of paint – that what most people think is a scratch in paint is actually in a clear coat?

Ahmed Al-Wajih: Traditionally vehicles had a single stage paint, which was oil based and was just paint onto of the panel. Today we have three-layer paints on most panels, if not all. It consists of primer, base coat and the clear coat. The base coat is the actual colour that you see and the clear coat is a transparent layer that adds the final finish to the paint. The clear coat also provides a layer of protection to the base coat. Therefore the swirls, holograms, dullness in the paint are typically imperfections on the clear coat and not the base coat. Deep scratches that can be felt by your fingernail usually mean that the damage has gone beyond the clear coat and into the base coat or primer.

LUX: What does ceramic coating (and the other protection you supply) do?

Ahmed Al-Wajih: A ceramic coating for the paintwork is designed to protect the vehicle’s surfaces. The main purpose of a ceramic coating is to bond with the clear coat to make it harder, therefore more resistant to swirls and light scratches, as well as to provide protection against oxidation. It also provides high levels of gloss and hydrophobic qualities.

For the interior, chemicals were used to protect the floor mats and carpets. The purpose of this is to protect the carpets from stains caused by liquids and dirt that can become imbedded into the fibres. A sealant was used to protect the leather from dye transfer and to help clean the leather much quicker.

LUX: What is the difference between ceramic coating and traditional wax?

Ahmed Al-Wajih: The main difference between ceramic and wax to the paintwork is durability. A ceramic coating is a long-lasting coating that bonds within the clear coat particles. For example Gtechniq’s flagship ceramic, the Crystal Serum Ultra, is warranted for nine years. It will not wear away with aggressive washing chemicals, or even machine polishing, the only way to remove it is by sanding down the panel. A wax coating on the other hand may be topped up by layers, however an aggressive chemical will take the wax of the surface.

LUX: What exactly did you do in the process of coating our car?.

Ahmed Al-Wajih: First step in our process is to decontaminate the vehicle and strip off any sealants that are on the vehicle. This is a crucial part of the process as we need to ensure that the paintwork is clean and without any contaminates before we can move onto the next stage. Once the vehicle has been decontaminated and dried, we worked on the interior, again ensuring that all surfaces were clean.

The vehicle was then put on our ramp and we safely raised the car and removed the wheels. The wheels were then taken to our wash bay to be cleaned once again. The wheel arches were also cleaned again. Once the wheels were dried, they were protected using Gtechniq C5 wheel armour. The callipers were also protected using the C5 wheel armour. The interior was then protected using Gtechniq’s L1 leather guard for the leather surfaces and I1 Smart fabric for the carpets, alcantara and floor mats. The I1 Smart fabric was also used on the soft top.

We then inspected the vehicles paintwork and identified specific areas that needed extra attention and correction. We masked the vehicle and began our correction of those areas. Once this was complete we gave the vehicle a one stage enhancement process with the aim to further enhance the depth of the Obsidian black and ensure that the paintwork is in the best possible condition.

Once this process was complete we began prepping the paintwork using a panel wipe. The purpose of this process is to clean the panels and ensure that they are free from anything that may contaminate the application of the ceramic coating. Once this process was complete we began applying the Crystal Serum Ultra. Once we completed this process we left the ceramic to cure overnight. The following morning we inspected the paintwork to ensure that the ceramic had bonded properly. We then applied C2 Crystal laquer which acts as a top up coating for the ceramic. We also protected the glass using Gtechniq’s Smart Glass. Once we were happy that the ceramic to the wheels, body, interior and glass had cured we safely put the wheels back onto the vehicle and ensure that the wheels were torqued back up to the manufacturer’s specification.

Once again the vehicle was moved to our final inspection bay [with all round flourescent lighting] and we gave the vehicle a final inspection to ensure that it met our standards.

LUX: Why use Gtechniq products?

Ahmed Al-Wajih: Gtechniq is a leader in the world of ceramic coatings. They put a lot of research and development into their products and stand by them. There are many different brands for ceramic coatings but there are very few that have the same international recognition.

LUX: There are detailers offering clients mobile ceramic coating in hours. Your process takes three days. What is the difference?

Ahmed Al-Wajih: There are different levels of ceramic coating, There is a liquid ceramic coating which is very easily applied, you spray it on and wipe it off. There are also ceramic coatings which are not semi-permanent which can also be applied without the risk of causing much damage as removing the coating is easy.

Once you get to the semi permanent coatings such as the five year or nine year coatings, you need the paintwork to be perfect before you apply the coating as any imperfection will be locked in for the duration of the ceramic coating. It is not impossible, however it puts the person applying the coating at a big disadvantage.

We have a studio where we are able to control the lighting, temperature, and positioning of the vehicle. All of this helps us to produce incredible and consistent results.It would be a big disadvantage trying to correct a car with poor light and bad weather conditions.

LUX: People buying a brand new car may not believe their car needs paint correction (ahead of protection). Tell us what you find on brand new cars.

Ahmed Al-Wajih: Believe it or not I have yet too come across a brand new car that is without imperfections. To the untrained eye the car may be glossy and shiny but to a trained eye, there are swirls, light scratches from where the vehicle has been valeting prior to delivery. The vehicle may have been in transport and exposed to the elements. causing etchings on the paintwork Many people do not see the imperfections and are happy to live with it, but if you are going to project your vehicle, you would really need to perfect the paintwork, because if you see it over the coating, there is not much that can be done.

LUX: Why choose a ceramic coat over a clear paint protection film wrap?

Ahmed Al-Wajih: If you are after protection, then the best form of protection is PPF (paint protection film). It protects the paintwork far better than ceramic. However PPF is costly and can cost more per panel than if you were just to have that panel painted. Also the level of shine and depth does not match that of a ceramic coating, although having said that, technology in PPF has come a long way and the quality is getting better.

LUX: For classic cars, you may still suggest a wax instead of a ceramic coat. Why?

Ahmed Al-Wajih: When recommending a product, we try to identify the purpose of why your vehicle is with us and what it is that you are trying to achieve. If you have a classic car that is garaged most days in the year and sees the odd outing to an event, chances are that the vehicle would not be exposed to a lot of contaminants. In addition tot his the paint may be very thin from previous years and a correction would not be suitable. A carnauba wax finish in this instance would be more suitable. The vehicle would still have protection, the paintwork would still have gloss and depth in the colour and more layers can be added on. If that same vehicle was to be parked on the street and driven daily thence would suggest a ceramic coating.

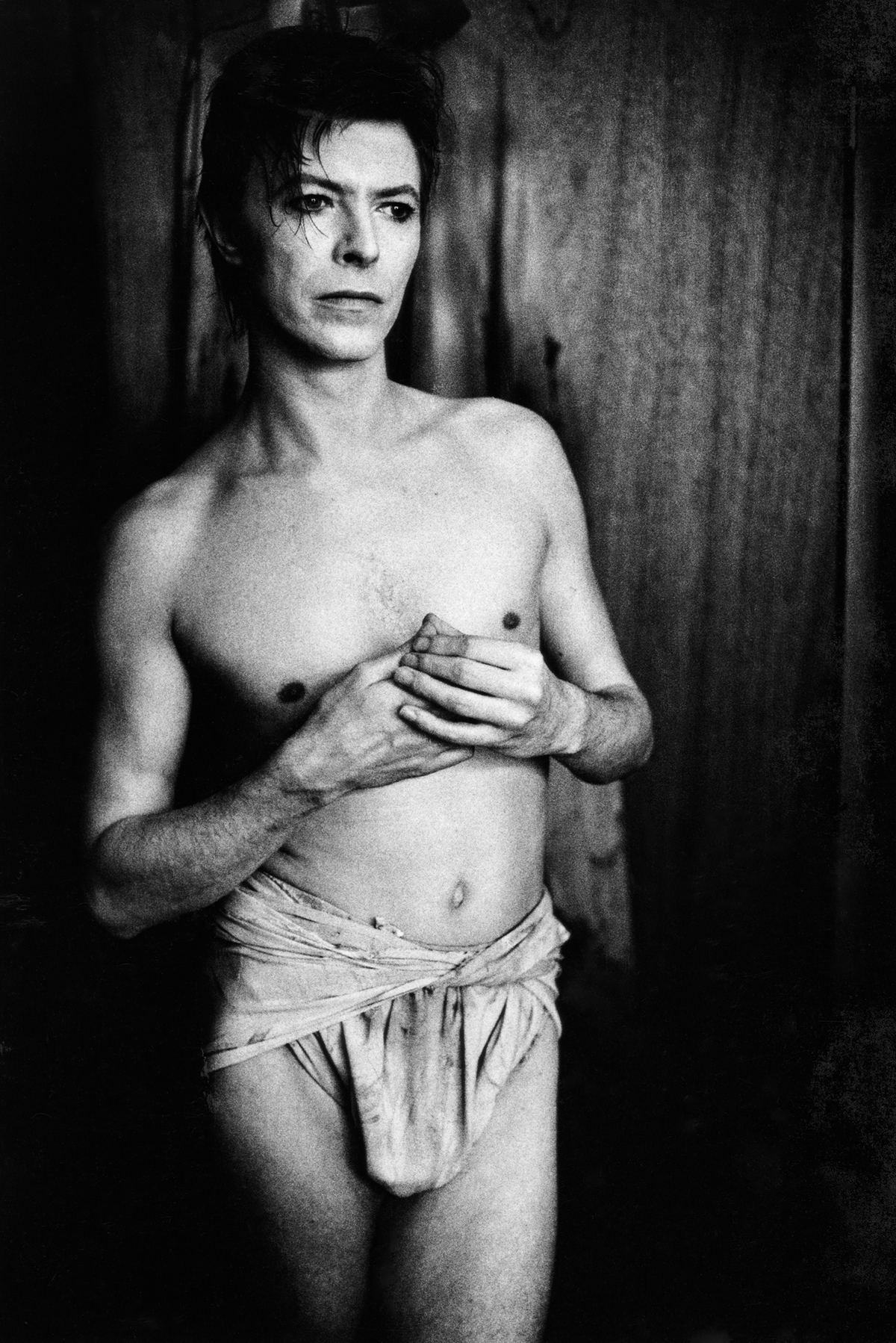

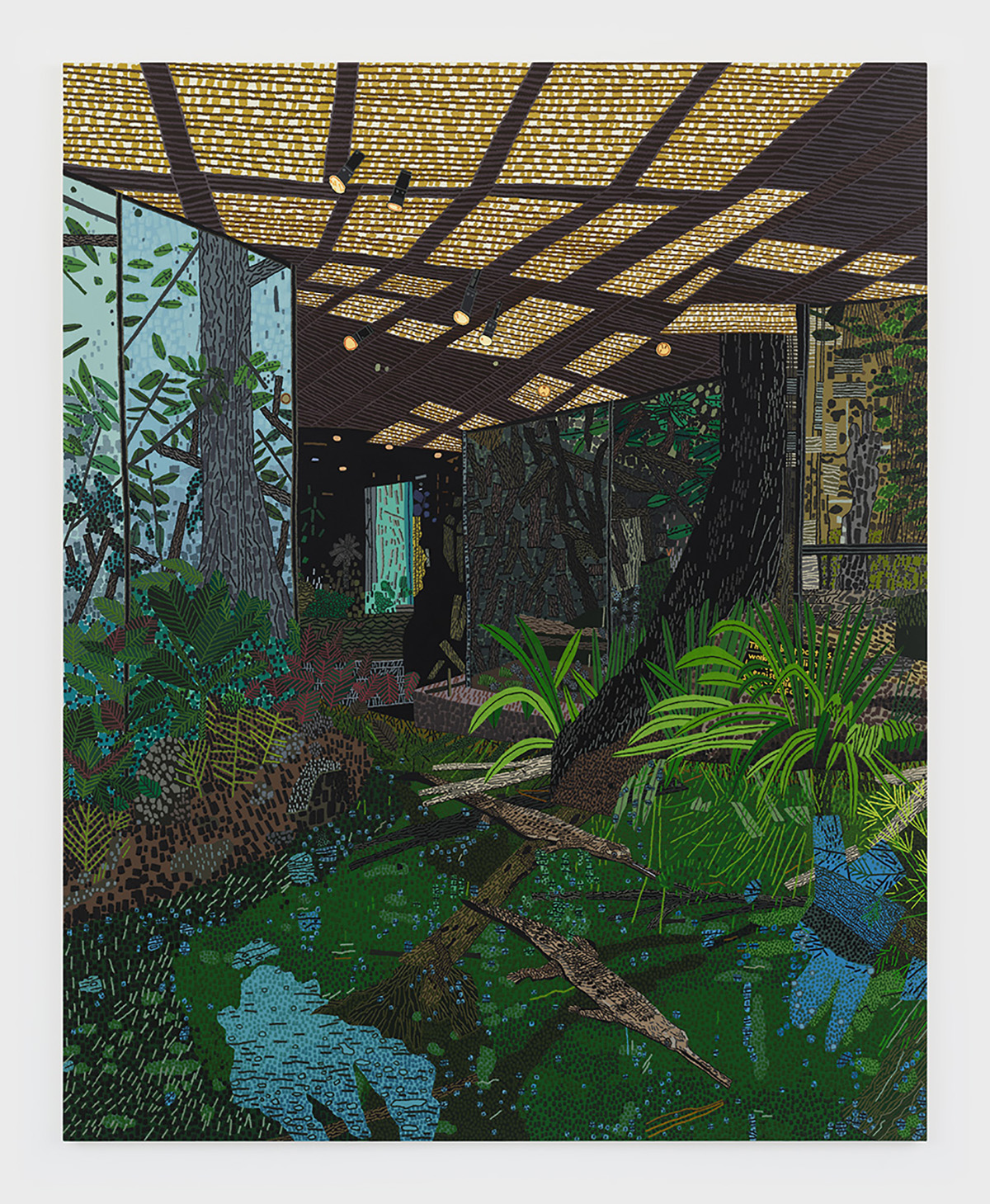

Portrait and product photography by Isabella Sheherazade Sanai

1. Of all the things you might collect, you chose ‘tat’. Why?

1. Of all the things you might collect, you chose ‘tat’. Why?

Recent Comments