Aubain – dancer, yogi, community leader and refugee – takes a break in Nakivale refugee settlement, Uganda, April 2018; photographed by Nachson Mimran

As the number of high net worth individuals increases, the philanthropic sector funded by their wealth has expanded. But is philanthropy genuinely effective and useful? In this feature, LUX speaks to some of the leading players to establish how the future of the sector is – and should be – shaping up, and discovers the pitfalls to avoid

In 2018, Rob Reich, Professor of Political Science at Stanford University in the US, shook the world of philanthropy with his book, Just Giving. In it, he claimed that the world of philanthropy was failing democracy, particularly in the US.

Many philanthropists “were not giving away enough”, their foundations were opaque and they were not having the desired positive outcomes. Reich’s book stirred timely and impassioned debate in a global philanthropy sector that has grown in the past decades to be worth more than an estimated £182 billion (US$228 billion) by 2023, according to The National Philanthropic Trust.

But while some of his theses continue to have merit – in particular, questions about motivations for some philanthropic endeavour – it is also clear that much philanthropy has been evolving rapidly, becoming more efficient and focused on delivering transparent solutions to major issues that cannot or will not be solved either by purely public or purely private capital.

Olena (26) with her children, Artem (8), Sofia (3), Oleksi (7) and Zlata (18months), who were taken away from Olena and put in an institution in Ukraine when Olena couldn’t afford to look after them. Social workers from Hope and Homes for CHildren (which is funded by charitable trusts and foundations including UBS Optimus Foundation) supported Olena to improve her financial situation and helped her get her children back home again

A fundamental starting point is to focus on achieving systemic rather than symptomatic change, says Tom Hall, UBS Global Head of Social Impact & Philanthropy. To do that most effectively, philanthropic and investment capital need to work together to create leverage around areas of fundamental global importance, such as climate, education and health.

“We have to be smart about how we allocate both philanthropic and investment capital, and we have to work in partnership with all of civil society to build the kind of economy that’s required to have sustainable pathways for people to prosper and for us to protect our planet,” he says.

These aims are encapsulated in the United Nations Sustainable Development Goals (SDGs) and, while some may take issue with the United Nations and the concept of SDGs in general, there is little room for doubt that addressing the focal points highlighted by these 17 goals is fundamental to global health and wealth in the future. At the heart of it all is sustainability, which means ensuring a healthy planet and an equitable future for all people on it.

Footballer Patrice Evra, seen through Extreme E tyre, Neom, Saudi Arabia, March 2023; photographed by Nachson Mimran

Every endeavour must be approached through this lens, including philanthropy. In addressing this point, philanthropy has to become bolder: this means doing the research, taking risks, measuring results and leveraging both its capital and its connections with private and public capital.

And, as we will see, it is starting to do so. Keys to this approach are blended finance and social-impact enterprises, which can both leverage and catalyse philanthropic capital in ways that traditional grant-making cannot.

For example, UBS Optimus Foundation and Bridges Outcomes Partnerships, a specialist non-profit, has developed the SDG Outcomes initiative. This works with governments, corporates and other outcomes funders to design, support and deliver SDG-aligned projects in low- and middle-income countries, particularly across Africa and Asia.

It uses an innovative blended-finance structure that sees UBS Optimus, funded by donations from over 30 UBS clients, providing 20 per cent first-loss capital to unlock further impact-driven capital. Any philanthropic funding returns are recycled into future projects.

SDG-linked themes are resoundingly supported by many of the new generations of philanthropists, such as Nachson Mimran, an entrepreneur, philanthropist and creative based in Switzerland. “I felt a shift in the conversations I was having with friends around dinner tables in about 2016.

People started asking questions about sustainability, climate change, poverty and global migration in the context of corporate social responsibility,” he says. “This happened to be around the time the UN launched its 17 Sustainable Development Goals.

A year earlier, my brother Arieh and I had already launched to.org – a platform operating in venture capital, philanthropy and the creative space, focused on accelerating solutions to Earth’s most pressing challenges – and we were excited that collective attention was turning in a similar direction.

“I believe,” he continues, “that Millennials and Gen Z are having these conversations and beginning to think about integrating philanthropy into business much earlier in life than previous generations.

My personal belief is that the most successful businesses of the future will be those that choose to respond directly to several – and not just one – of the 17 SDGs.”

Different perspective, similar approach: James Chen is Chair of the Hong Kong-based Chen Yet-Sen Family Foundation, and espouses a risk-taking approach for philanthropic capital, which can then leverage the reach of international organisations.

Follow LUX on instagram: luxthemagazine

Rohyinga children, Kutupalong refugee settlement, Bangladesh, December 2017; photographed by Nachson Mimran

“Philanthropy has a storied history of success, and private donors have played a critical part in funding important social advances, both big and small,” says Chen. “But some of today’s global challenges need a different approach, one that requires time, expertise and investing in risk-taking entrepreneurial ideas.

It is an approach that I and others call ‘moonshot philanthropy’. Drawing on President John F Kennedy’s ambition to put a man on the moon, it is about more than just donating money; it’s about making a philanthropic investment in an ambitious venture that has the potential to catalyse system change.”

Noting that 2.2 billion people around the world are affected by poor vision, which adversely affects their education, health, work opportunities and gender equality, as well as productivity, Chen launched his Clearly campaign in 2016, backed by his family’s philanthropic capital, because, he says, philanthropic capital can afford to take a risk to lose capital where organisations like the World Bank and USAID can not, due to their strict accountability rules.

As well as funding technology and campaigns in developing countries, which have led to millions having consistent access to eyeglasses from childhood, Chen was a key mover behind the United Nations resolution, passed in 2021 and adopted by all 193 member countries, to ensure affordable eyecare for all by 2030.

Professional leadership and creating connections between the philanthropic sector and the private and public sectors is critical, according to Maya Ziswiler, CEO of UBS Optimus Foundation. “More and more philanthropists are telling us that having a passion for doing good is not enough and that they want to see measurable outcomes based on their action,” she says. “How can you take advantage of your passion with rational thinking to ensure you’re actually having an impact, and working with others to maximise that impact?

The problem isn’t that there is a lack of money out there; it’s making sure that the money becomes accessible and that the capital is pooled to scale impact. “When we become involved in a programme,” she continues, “we always think, what are the routes to sustainability and scale?

There are two ways you can make sure a programme is sustainable and will continue after philanthropists decide to exit, and that is either that a government takes it over, or businesses take it over. Philanthropists need to make sure that they have the right understanding of how those systems work and then build those relationships.” UBS’s Hall agrees that the leveraging of relationships between the sectors, and in the way philanthropy works, is essential, if the funding gap for Sustainable Development Goals, currently in the trillions, is to be closed. Even with the dramatic growth in philanthropic capital, private giving alone will not be able to do it.

Girl collaborating with to.org, creative activists in a street-art, project, Libreville, Gabon, November 2018; photographed by Nachson Mimran

There are few more seasoned hands in the worlds of philanthropy and proven and effective sustainability than Julie Packard. The multiaccolade ocean conservationist is Vice Chair of the David and Lucile Packard Foundation, and co-founder and Executive Director of the Monterey Bay Aquarium.

Her programmes, such as Seafood Watch and the Southeast Asia Fisheries and Aquaculture Initiative have been globally recognised game-changers for sustainability – across general education, consumption and the realignment of production to sustainable practices.

“Having served on the Packard Foundation board for 50 years now, I’ve seen a lot of change in philanthropy,” she says. “One is the natural trend to move from working on local-scale issues to global approaches, which focus on getting at the root causes of the problems we all aim to help solve. “Over time,” she adds, “our experience at the Packard Foundation has made it clear that we must be more equitable and inclusive in our relationships with the partners in whom we invest.

In the past, foundations – including ours – had a set of priorities, and we set out to find organisations whose own work matched those priorities. We’re working hard to get away from this top-down approach. Philanthropies are also, as we are doing, directing more funding to people and communities who have been historically excluded, so that they have seats at the table to design and implement solutions.

The philanthropic community has a lot to learn to shift our historical ways of working, so that all voices can be heard and we can best contribute to lasting positive change for all.

Basket stars, seen at Monterey Bay Aquarium’s “Into the Deep” exhibition. Oceans produce the majority of the oxygen on the planet and life underwater is a massive carbon sink. Healthy oceans are essential for healthy and sustainable life on Earth

”Bringing private, public and philanthropic capital to work together through blended finance, social entrepreneurship and shared expertise, around conservation and sustainability, is a focus of the Prince Albert II of Monaco Foundation.

It organises numerous forums around the blue economy and finance; hosts the annual Monaco Ocean Week conference, which brings together investors, entrepreneurs, NGOs, the public sector and philanthropic capital; and launched the €100 million ReOcean Fund in 2023 to accelerate, build and mobilise capital around the ocean economy. “The challenge of progressing planetary health is only possible through collective effort,” says Olivier Wenden, CEO and Vice Chair of the Foundation’s board of directors.

“This is why the Foundation’s action is based on a holistic and collaborative approach of global environmental issues. We aim to unite scientists, political leaders, economic players and representatives of civil society to maximise our positive impact.” Wenden cites its Ocean Innovators Platform, launched two years ago, as “a good example of how collaboration can accelerate positive change.

Putting together innovators with philanthropists and investors in the same room is a very powerful way to scale-up solutions.” Leveraging is also about human capital and expertise done effectively and entrepreneurially.

Pritzker Architecture Prize winner, Diébédo Francis Kéré, poses in front of The Throne, a portable toilet 3D printed using plastic medical waste, Switzerland, August 2021; photographed by Nachson Mimran

Read more: Alan Lau and Durjoy Rahman on the importance of art philanthropy

Ben Goldsmith, a British investor, conservationist and philanthropist, launched the Conservation Collective in 2020 from an existing conservation initiative. A hub and accelerator for conservation and sustainability action, it now encapsulates 20 independent philanthropic organisations around the world.

“Just as with venture capital, I have always thought that if every project is working, you’re probably not taking enough risk,” says Goldsmith. “All the challenges are the same as a startup; there are tremendous parallels between them. £1 of overhead at the umbrella charity creates around £12 for the underlying foundation. We’re not far away from having given away around £15 million and we’re also launching new foundations in Bermuda and Mauritius.

If you can create these local foundations, they become hubs of activity.” Agreeing with UBS’s Hall, Goldsmith says addressing root causes is fundamental. “There’s a tendency in environmental philanthropy to ‘provide service’. We don’t want to just fix things, we want to be funding groups who are striving to change the system.”

In terms of systemic change, Hall also speaks about the importance of addressing issues at their root, and overcoming built-in societal prejudices that can, for example, cause a black woman looking for startup capital for a social enterprise in Africa to be confronted with ruinous APR rates on a business loan. Mimran’s to.org funds significant social-impact investors in developing countries in Africa, with local expertise and global networks providing leverage and amplification that grant-making alone could never have provided.

Jessica Posner Odede knows all about creating lasting societal change in Africa. She is CEO of Girl Effect, a major international non-profit that works primarily in Africa and South Asia. Girl Effect uses media and technology to provide girls with tools that can change their lives, in terms of information, empowerment and education, in societies where women – half of the population – are deprived of opportunity, rights and the chance to play productive roles. Entrepreneurial thinking is essential for foundations, according to Odede.

“Look at consumer businesses,” she says. “You see millions of dollars and also time and energy spent on thinking about consumer journeys, marketing – how does somebody know their product or service? You would never launch a commercial venture without thinking through those user journeys, to see how to reach your customer. In philanthropy, there has been an assumption that people need certain things and will just use them.

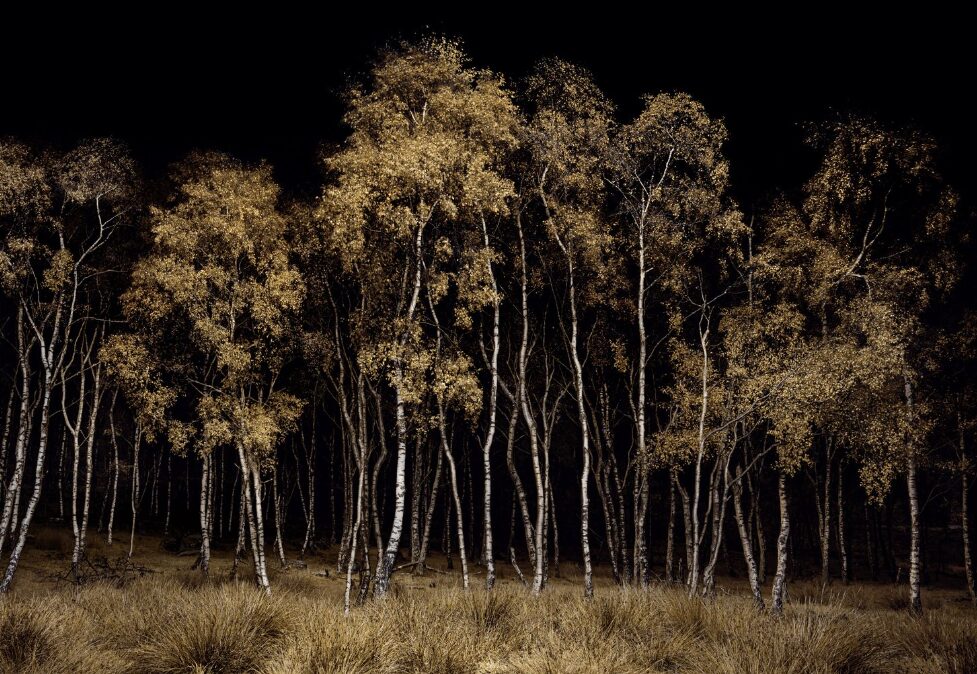

From the “Twilight’s Path” series by Jasper Goodall, whose images were shortlisted for the Photography Prize for Sustainability, created by UX in 2022. Investment in stewardship of land-based ecosystems contributes to biodiversity, which underpins sustainability

This has been a huge misconception and has resulted in a lot of ineffectiveness in terms of services utilised.” Odede says that in the African and South Asian countries that Girl Effect operates in, they ensure they know their end user. “We work very closely with health ministries, girls, parents and local health systems; we establish how you build diverse stakeholder collaboration in a way that is led by people designing the solutions who have also experienced the problems.”

So, was Stanford’s Rob Reich correct, back in 2018, to highlight how philanthropy was being challenged? He was, in some respects. But we can see how visionaries and effective players, old and new, are changing the game dramatically for the better.

As UBS’s Ziswiler says, “More and more we are seeing that billionaires see it as their responsibility to resolve global issues, and about 90 per cent of them are very serious about their philanthropy. But they are also realising that philanthropy alone can’t help us bridge the funding gap.

We have realised that philanthropy can be much more catalytic, it can take more risk, it can be more flexible.“The added benefit,” she says, “is that potentially money could be used more than once in a structure like that, because the potential for me to get my money back means I can redeploy it.

Not only is there more impact because more money is coming in and is being leveraged more effectively, there is also more impact because the money I was going to deploy once, I can now deploy again and again.” There are still caveats, though.

For example, there are no industry standard metrics to demonstrate effective and long-lasting causal change, which means measuring return on philanthropic investment utilises metrics and analyses that are often imperfect – even with the best intentions.

“The example of what good quality looks like here is in the health sector, where you need a clinical trial to bring your product and service to the market,’ says UBS’s Hall. “We don’t have that mandated in almost any other field.

It remains a challenge.” Like all of human endeavour, then, the world of philanthropy is flawed – but it is also irreplaceable and, through its recent evolutions, it is making an increasingly positive impact on the world by joining forces with other human creations. Humanity’s philanthropic journey will be long and potentially endless, but there is every reason, and an increasing amount of tools, to embark on it with the highest of rational expectations.

Recent Comments