Knight Frank launched its 2020 Wealth Report at Chelsea Barracks, a new luxury residential development in Belgravia, London

Last week saw the official launch of the 13th edition of Knight Frank’s Wealth Report at Chelsea Barracks in Belgravia, London with a new focus on on data relating specifically to ultra-high net worth individuals, providing invaluable insight for investors and those seeking to buy new homes. Here’s what you need to know

Wealth is increasing on a global scale

Despite geopolitical uncertainty, the global number of ultra-high net worth individuals (UHNWIs) is still growing and is expected to rise by 27% over the next five years, taking the total to an estimated 649,331.

The US still dominates with the largest UHNWI population (240,575), followed by China (61,600), Germany (23,000), France (18,800), Japan (17,000) and the UK (14,400). India has the fastest growing UHNWI population with an estimated 73% rise over the next five years.

Follow LUX on Instagram: luxthemagazine

New York wins for lifestyle

The report assesses 100 cities based on their global appeal as a place to invest, live and spend time. This year, New York came top, pushing London into second place followed by Paris, Hong Kong and Los Angeles.

Wellbeing is a new priority

According to The Wealth Report Attitudes Survey, 80% of UHNWIs are dedicating more time and money into their wellbeing. There is also a growing focus on wellness as a measure of national performance with Oslo in first place followed by Zurich and Helsinki tied in second place.

And so is sustainability

This year’s report discusses the impact of luxury travel on the environment, featuring insights from William Mathieson, Intelligence Director of The Superyacht Group and Thomas Flohr, Founder and Chairman of Vistajet into how their businesses are becoming more sustainable.

Read more: Darius Sanai’s Luxury Travel Views Spring 2020

Residential trends are changing

The report also includes the latest results from the Prime International Residential Index (PIRI), which places Frankfurt at the top of the second homes market, followed by Lisbon, Taipei, Seoul and Houston.

Lord Andrew Hay, the Global Head of Residential at Knight Frank, presenting data at the launch of this year’s Wealth Report

10 neighbourhoods to watch according to Knight Frank’s property experts:

1. Road to Amizmiz, Marrakech, Morocco

2. Fengtai, Beijing, China

3. Sentosa, Singapore

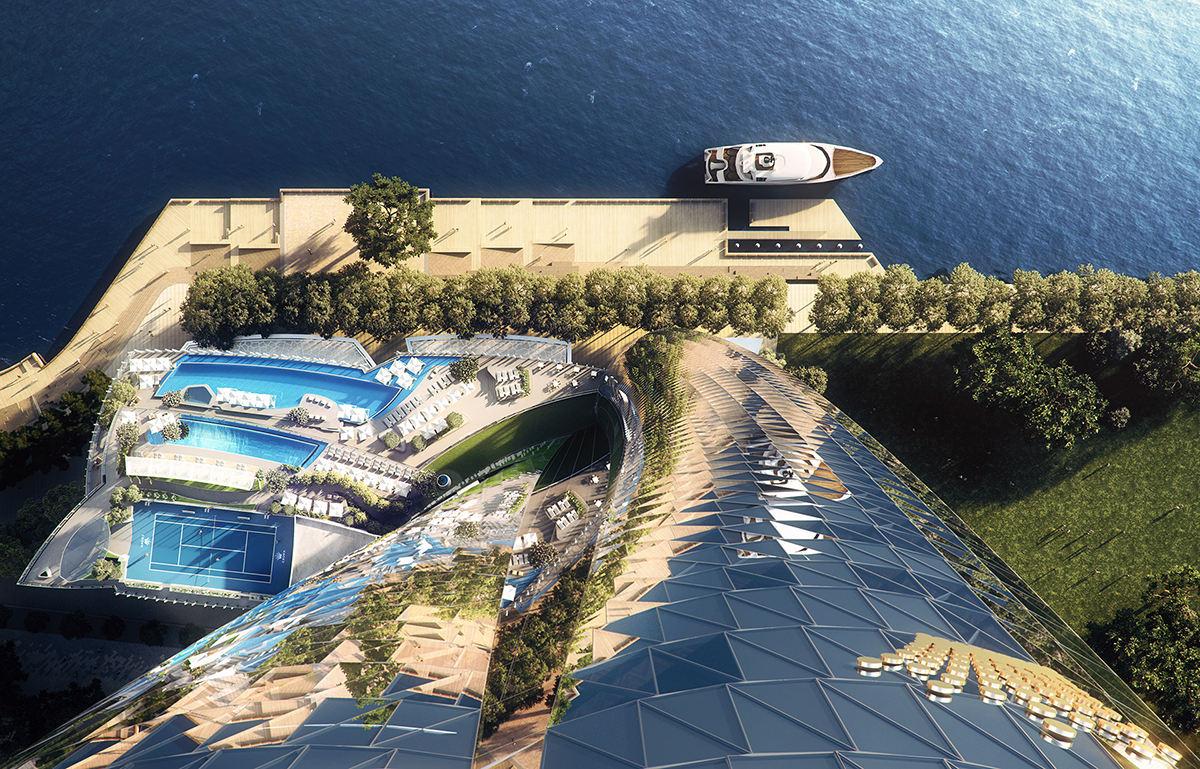

4. Sydney Harbour, Australia

5. St Martin-de-Belleville, The French Alps, France

6. SoPo, Berlin, Germany

7. Mahou-Calderón, Madrid, Spain

8. Maida Vale, London, UK

9. Museum District, Houston, US

10. Imperial Beach, San Diego, US

To view the full wealth report visit: knightfrank.co.uk

Restoring the Garrison Chapel

The Garrison Chapel was constructed in 1859, and functioned as an active church for 150 years before it was deconsecrated. In 2018, after an extensive refurbishment supported by the Chelsea Barracks Chapel Trust, the building was reopened as a community arts and culture space.

Watch the below video to learn more about the project:

Chelsea Barracks – The Garrison Chapel from Chelsea Barracks, London SW1 on Vimeo.

For more information on Chelsea Barracks visit: chelseabarracks.com

Recent Comments