An NFT from Tezos

They’re being shown at Basel, included in Venice: let’s see what the data tells us about NFTs and their long-term potential. Our contributing editor and columnist Sophie Neuendorf looks into it

Sophie Neuendorf

At this point, I believe that most of you will have heard of the phenomenon that’s taken the art world by storm: Non-Fungible Tokens, better known as NFTs. Ever since Christie’s sold that now famous NFT by artist Beeple for $69 Million in March 2021, this nascent category has grown exponentially. Over the past year, something like $44 billion has been spent on about 6 million NFTs, usually issued to certify digital creations but sometimes for physical objects such as paintings and sculptures.

The popularity of NFTs can be attributed to several factors. Primarily, it can be attributed to the rapid digitalisation of the art industry. Now, more and more artists, collectors, and professionals are comfortable with browsing, interacting and transacting online. This coincides with the cultural shift to the metaverse, which is a digital copy of the real world. It’s unsurprising that the metaverse should include fine art and collectibles, given that luxury fashion brands such as Gucci, Prada or Ralph Lauren are also represented.

Jimmy Fallon’s NFT by Bored Ape Yacht Club

But how can one identify ‘good’ or ‘bad’ NFTs and NFT artists? How do we know which NFTs are a good investment? This process is not much different to that of traditional art: after a period of time, a selection of NFT artists will crystallise as those that are most in- demand and desired. This may be a reflection of tastes and preferences but also of the zeitgeist and, most importantly, of who collects them. Many of us look to tastemakers and well known gallerists or collectors to see what they are buying, then use that information to help us form an opinion.

As one does before committing to a traditional work of art, it’s important to research prices and comparables before purchasing an NFT, as the market for NFTs has evolved and changed rapidly, even within the past year.

Follow LUX on Instagram: luxthemagazine

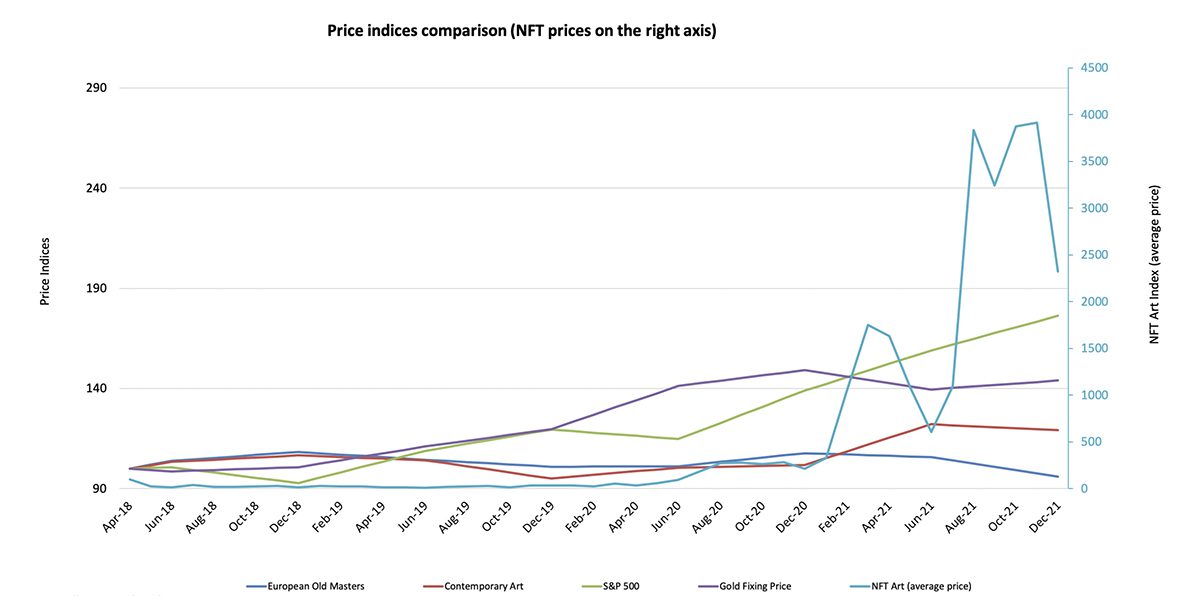

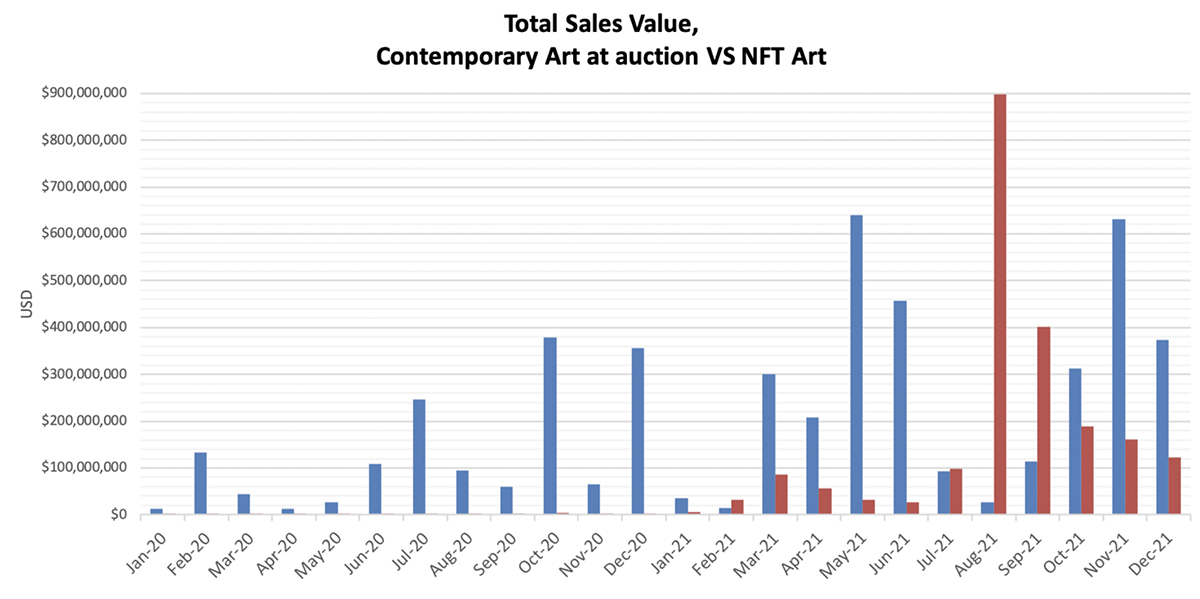

As you can see from the graph, the prices for NFTs appreciated rapidly from the spring of 2021. However, since the end of last year, NFT prices have experienced a correction – the average transaction value has decreased substantially. This is in no way a reflection of the long-term viability and value of NFTs as a collecting category, but can be interpreted as the stabilisation of the market. Much more volatile than other assets or collectibles, such as contemporary art or gold, NFTs also suffer from price fluctuations due to the changeable nature of cryptocurrencies. Additionally, as it’s a new category, speculators may see it as less viable and secure as an investment in comparison to traditional blue-chip categories (as demonstrated below, on this page) – as yet, in terms of art as an investment, postwar and contemporary art, for example, are seen as much more secure than the nascent NFTs.

Yuga Labs is the company that is responsible for the extremely pricey ‘Bored Ape Yacht Club’ NFT series. At the beginning of this year, they announced the acquisition of the intellectual property behind their rival Larva Labs’ CryptoPunks and Meebits projects. This means that now three of the world’s most important crypto companies are under one blockchain-supported roof. Yuga Labs thus attempts a novel solution to a riddle facing more and more art professionals in this era of Instagram-ready immersive installations, branded merchandise, and fractionalised ownership: how do you turn a niche obsession into a mainstream phenomenon?

One of 10,000 avatar NFTs created by Azuki

Yuga Labs’ answer is to grant direct financial incentives to NFT owners to help the company build – and market – a creative universe around its tentpole intellectual property (IP). The move makes an expensive category accessible to a potentially much wider fan base. Despite the correction in transaction value, these popular NFTs are still expensive. The cheapest Meebit now costs about 5.6 ETH ($14,500). The floor price for a CryptoPunk is about 75 ETH ($195,000). Bored Apes sell for at least 97 ETH ($250,000).

Read more: Maryam Eisler On Tim Yip’s ‘Love Infinity’

‘Rebirth’ by Beeple

This new development answers the question of how to build a broad fan base for IP in such short supply, and with such impressive price tags: create derivative works available at low costs. Think of the Basquiat estate licensing the artist’s imagery for Uniqlo T-shirts. The difference is that Yuga Labs is outsourcing this task to NFT owners, rather than proliferating the Punks, Meebits, and Apes in house. Yuga Labs will give direct financial incentives to NFT owners to help the company build and market a creative universe. Or, to compare it to the traditional art world: create prints off of original works on canvas for a fraction of the price.

NFTs have already been shown at major fairs, such as Art Basel. This year’s Venice Biennale is showing NFTs in the Cameroon Pavilion. Galleries and museums, such as the Uffizi and Belvedere, are issuing NFTs of their Old Master and modern paintings. With auction houses such as Sotheby’s, Christie’s, and Artnet auctions regularly offering NFTs, it’s only a matter of time until they are less of a novelty and more fully integrated in the traditional art industry.

Sophie Neuendorf is Vice-President at Artnet

This article first appears in the Summer 2022 issue of LUX