Wendy Yu flies between London and Hong Kong for her businesses on a regular basis

Wendy Yu is an entrepreneur and philanthropist, and the founder and CEO of Yu Capital. With investments in China and Europe in fields as diverse as transportation and sustainable fashion, Yu is a visionary – with a penchant for dresses. As the youngest member of the British Fashion Council board of trustees, founding member of the Victoria and Albert Museum’s ‘Young Patrons Circle’ and heir to her family’s business Mengtian Group (China’s leading wooden door manufacturer), she is a Renaissance woman par excellence. Kitty Harris chatted to Yu over an English breakfast in London about her new group, Yu Holdings, sustainable impact investment, and her healthy obsession with ball gowns.

Wendy Yu

LUX: Your father runs the Mengtian Group and your mother is a successful private investor. What are the most important lessons you learnt from them?

Wendy Yu: Resilience and being determined. I think my dad is a dreamer, but he is genuinely determined and I really like that. He built his business from scratch and I think he has encountered a lot of hardships during his lifetime, but he never quit. He is always so passionate, determined and relentless about what he is going to achieve.

Since I was young, I have had the mindset that if I want to achieve something, I will find any possible way to achieve it. My dad has taught me about the ‘win-win’ mindset, that in everything you do, if you want to keep it sustainable, you have to not just do it for yourself, but also for others. Before I came to study in England, when I was fifteen, he had this really long talk with me. He said “there are three qualities that I want you to have in your life. First of all, to be a loving person. Secondly, always to fight for the better version of yourself and always think about how to improve yourself. Thirdly, never be afraid of hardships and be relentless about what you want to get.”

Follow LUX on Instagram: the.official.lux.magazine

LUX: As vice chairman of the family company is there ever any tension when working with family members?

Wendy Yu: Yes, absolutely. I am a very logical person, but sometimes with family business it can get too emotional when you have different ideas to each other. My dad is a very solid entrepreneur, but he is very Chinese. When he comes to England, he doesn’t eat British food and will only eat Chinese food. He loves spicy, authentic hotpot only at home. I think there is definitely tension, because there are so many big personalities and strong characters. But, at the same time we have bonded with each other and we just want the best for the company and the best for each other.

My dad is very happy with the company being one of the biggest manufacturers in Asia and China and he is happy with the brand. He is happy to make the most out of the Chinese market, because it is so big. My vision is really to expand my family business and legacy globally and to create a solid and well-established international company and brand. My education and experience in England, since my teenage years, has given me opportunities to grow up with both eastern and western mentalities and perspectives; that is where the conflict lies sometimes. Very recently I have restructured my company, Yu Capital, and the main entity will be based in Hong Kong. Under Yu Holding, there will be Yu Capital, Yu Culture and Yu Fashion, because I’ve realised so much of what I do is not just the investment. There is philanthropy, cultural exchange and fashion collaborations.

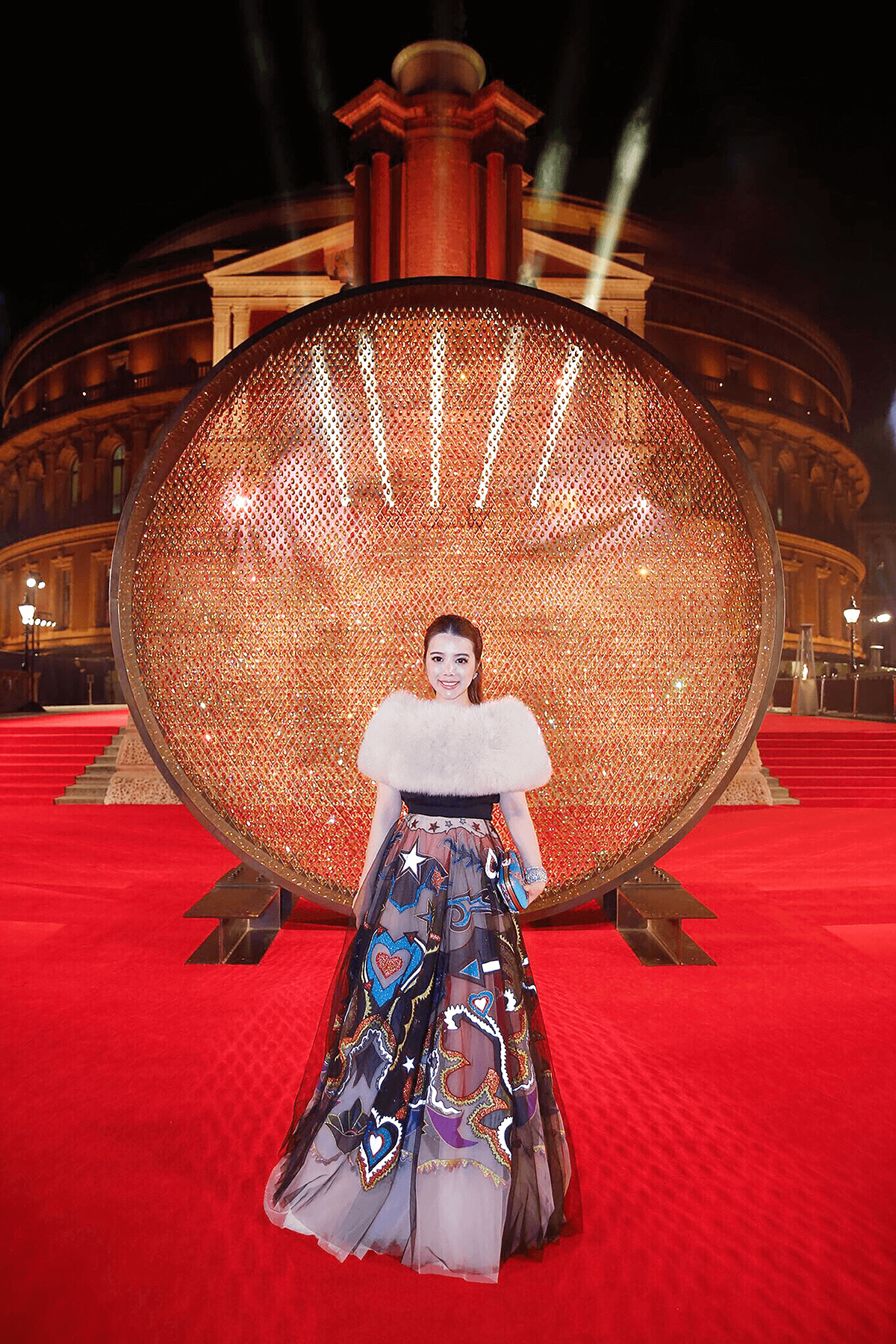

Wendy Yu at The Fashion Awards 2016.

My vision is to connect investments with the innovation and creativity between the East and the West and I feel that Yu Holding will be a better entity than Yu Capital to be strategic about engagement with these sectors. I usually divide my investments into financial investments and strategic investments. Yu Capital would be more focused on financial investments, that is on the technology side like Didi, the Chinese taxi app, and Tujia, China’s home-rental website and hedge funds.

The strategic investments would be in fashion, cultural exchange to support the museums and the art world, to connect art between the East and the West. Those are two of my big passions and I feel I can say that ninety percent of the time, I spend time on my own business: Yu Holding and Yu Capital. I feel the pressure that no matter what I do and how well I do within my family business, my dad will always be the person saying yes and no. I am like my dad, as I like having the say of what direction to go in. I think he will be proud to see what Yu holding is going to achieve in the next three years and I can prove that my vision isn’t bad or limited , because I want to do things globally, not just in China. I like being independent and I think it would be a waste of my experience and education here if I don’t connect the world with China.

Read next: Salvatore Ferragamo on family prestige and Tuscan indulgence

LUX: It sounds like your business is global, so it isn’t aimed at any one territory. Is that right?

Wendy Yu: Yes, that is absolutely right. I have two partners who stay in Shanghai and they come from very solid financial investment backgrounds, one of whom is my cousin. There is still a bit of family force there but that is to make sure that I don’t do anything crazy. Yu Holdings is really my vision and my two partners are amazing. They love that I am creative and pull off different business deals. They love the idea that I’m a great matchmaker. I am good at spotting and sensing which two companies or parties will potentially have great synergy and to be the bridge that joins them.

LUX: Is part of the plan to set up a luxury group?

Wendy Yu: Absolutely, but it would be in ten years, because I think I am at the beginning stage of my career. I think I leave my mark on everything I do, and it is important that the projects are commercially successful as well. With my strategic investments, I put less money in, but I have the presence and we help each other. I have a team doing the portfolio management for me, but at the end of the day, I am the one that is making the decisions. I think after you’ve done all the due diligence and risk assessments you have to go with your heart.

LUX: Why was it important for you to be involved in the Young Patrons Circle at the V&A?

Wendy Yu: I was invited to be the founding member of the Young Patrons Circle; they know I support a lot of different museums and art galleries, so it seemed natural that they asked me.

Sian Westerman, Caroline Rush (Chief Executive of the BFC) and Wendy Yu

LUX: You’re the youngest patron of the British Fashion Council (BFC) Trust – what does your role involve?

Wendy Yu: I joined a while ago and through the BFC platform I get to meet a lot of designers and learn the challenges they have encountered. I have become friends with a few of them and we have bonded. I support them by introducing them to all of my friends. I love to support women and the people I like, with no other intentions. When I think a girlfriend will like their work, I just introduce them to each other. It is a win-win situation for both of them and I take no commission! My family really believes in karma and I think that in the long-run, if you support people they will support you back. I usually get along with two types of people. One type is very creative (designers and artists) and the other type is those in the finance world. I think there are two parts of me, one is very geeky and numerical, and I love to be creative and to think outside of the box.

LUX: How much input do you have in your different investments?

Wendy Yu: I am tremendously involved in them. I am very hands-on and I chat to people for specialised advice. Usually, we have around one hundred deals to look at over a year. Normally, I have a sense of whether a deal will work or not. We do a very careful analysis for around thirty of them. Then, I look at the report and certain things I will naturally feel are great. For example, for Didi and Tujia I knew instantly that it would work, but I still asked them to do the analysis. Decisions have become relatively quick and we made both deals over a period of two months and they are big investments. But, with fashion investments, I have to get to know the designer on a more personal level. It is generally a smaller investment and I know it is not purely financial. My financial adviser will write the report listing the pros and cons, since it is a strategic, impact investment. When I invest in something, before I make my final decision, I think, ‘what is the worst thing that could happen?’ Of course, you should also consider what is the best thing that could happen, but if I can take the worst thing that could happen, then I am happy to do it. Bottletop was one of my first investments and I am very happy with it, even though I didn’t get any return from it. I love the idea and I think the two founders, Cameron Saul and Oliver Wayman, are amazing entrepreneurs. What they are trying to do (recycling bottletops to make accessories) is great and they are supporting women in Africa and Brazil. They are growing quite fast and at a steady pace.

LUX: What is the typical timeframe to hold and sell an investment?

Wendy Yu: When I first started, I invested at a very early stage. Later I realised that’s not my favourite type of investment, because you hold it for so long. What I really like are pre IPO investments. I really like opportunities like Didi and Tujia – large companies, because I believe those companies are really shaping our world, or shaping China at least. I love being part of the change in many ways and in terms of the financial return, for example the Didi deal, I got a 47% return over a 14-month period of time, which is great. You don’t really get that from the fashion brand. I invest through a fund and we sold part of our shares already. With hedge funds, it is very calculated. You would only put a few million in and the return could be over 100% each year, but it varies because it fluctuates over time. You could make a loss of 20%, or you could win 100%. That’s why you need to invest in different hedge funds. I am very involved and I am very passionate about it, because naturally I love numbers and I am very excited by them and I love creativity.

Dinner in Hong Kong, working breakfast in London

LUX: How do you think the investment market is going to change in the next ten years?

Wendy Yu: I think China and Asia, the emerging market, is extremely exciting. But, having said that, I think that you have to really value your opportunities carefully. I have noticed that a lot of investments that are making great returns are in China. It isn’t really happening in London. I think European or American investments, are very strategically relevant with what I want to do and achieve. It is a great value investment over the long-term. In the Chinese market, it is a great financial investment over a certain period of time. I am now also starting up a joint venture with my French partner Kacy Grine, who is an incredible capable and intelligent French banker, he was serving as an adviser of the former French President and has been a long time personal advisor Prince Al-Waleed, who is the biggest investor of Saudi Arabia. We are setting up a joint venture. We feel it is the time to connect the foreign giant technology companies or foreign brands in China and to do the matchmaking with you in the West. The Chinese companies want to go global and the global companies are interested in the Chinese market, but they really want to find the right partner and we are of value in this matchmaking process.

LUX: When you do the matchmaking, you obviously add value to your partners, but how do you benefit from it?

Wendy Yu: It varies from case to case according to the level of our involvement and the deal structure, but we generally act as their advisors and matchmakers.

Read next: Priya Paul of The Park Hotels on balancing innovation and heritage

LUX: In terms of sustainable investment, are you looking to be more sustainable in your investments?

Wendy Yu: Absolutely. I think my philanthropy investment and impact investment is very sustainable. I am trying to balance it out. A while ago, I studied at Oxford Saïd Business School while they were doing an impact investment programme, I was very inspired. I realised that when you pass away, you don’t leave anything. You only leave the good things you have done. I think until I reach a certain level in my career, I want to pledge the majority of my wealth to the company. I don’t want to keep it all, honestly. What Bill Gates and Warren Buffett have done is wise. I don’t want to hold on to so much. I want to enjoy life for sure, but one of my missions is to do things worthwhile that I’m proud of. I want my family to be proud that I am leaving something meaningful and sustainable, that will stay there for a long time.

Ethan K x Wendy Yu handbag collection at Harrods

LUX: Tell us about the inspiration behind the Ethan K x Wendy Yu handbag collection at Harrods last year…

Wendy Yu: We have been friends for a while and I’ve bought from him. He probably likes my energy and I like his energy. Just like with Mary [Katrantzou] and my other designer friends, we like each other’s energy. They inspire me and I inspire them. I always give them crazy ideas that they love. He said, ‘let’s do a Wendy Yu bag.’ I go to a lot of events, but during the daytime I’m working. I was thinking about a bag that I can use for nighttime and daytime and that is why he designed a bag for me that is very versatile. His clients are Hermès owners, or people who have bought a lot of different bags and they are kind of bored and now they want something bespoke. Ethan’s family had tannery at the back of their home, so he has the experience of doing a bag in crocodile skin that is boutique too.

The Wendy Yu butterfly piece by Anna Hu

LUX: How did your love of fashion begin? You have an impressive evening gown collection – do you have a favourite dress?

Wendy Yu: My love for fashion began at very young age, when I was little I enjoyed playing with and collecting Barbie dolls, then I started to collect fashion magazines when I grew up. I love to be constantly surrounded by inspirations and creativity of all kinds. In terms of my favorite dresses; I have two. Mary Katrantzou recently did a bespoke gown for me to open the exhibition ‘Creatures and Creation’ at the Waddesdon Manor. Anna Hu also did a bespoke ring for me and named it a Wendy Yu butterfly piece. Mary did the dress in ten days – can you imagine? We did the last-minute stitching on site. The other one is Giambattista Valli – he did two bespoke gowns for me when I did an international debutante ball in New York. He did it in about three weeks. I am really into dreamy, crazy gowns!

yu-capital.com

Recent Comments