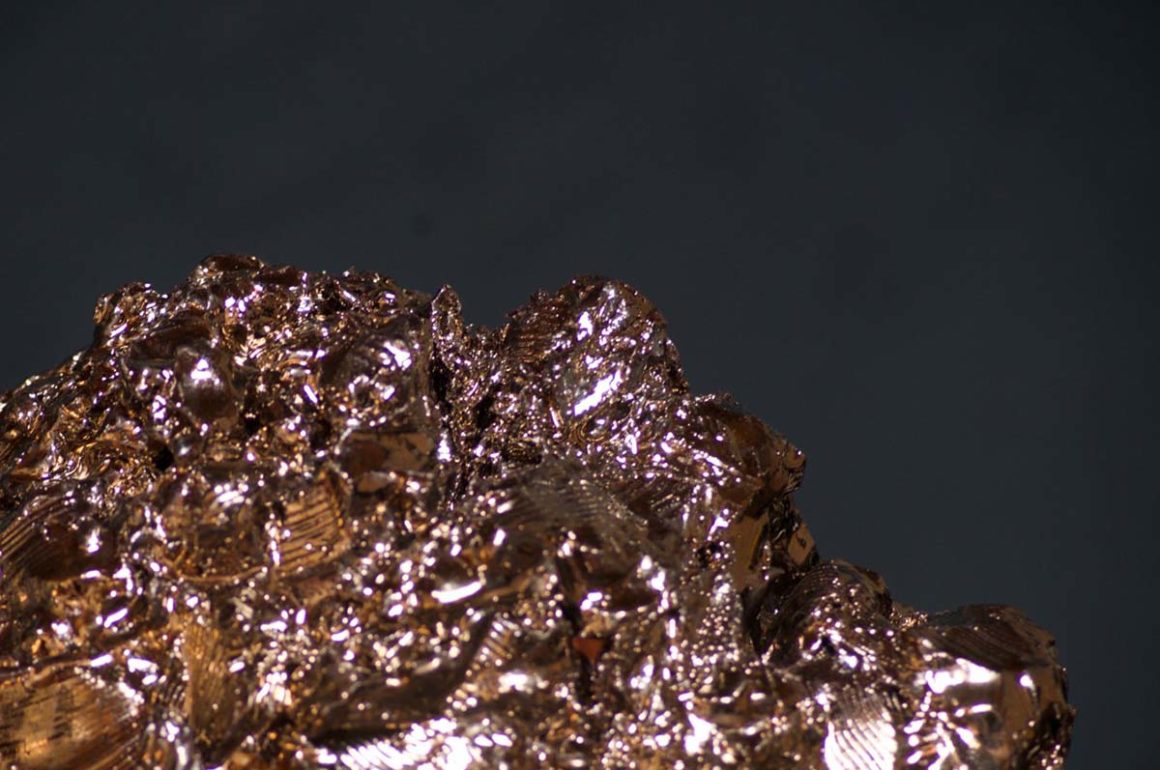

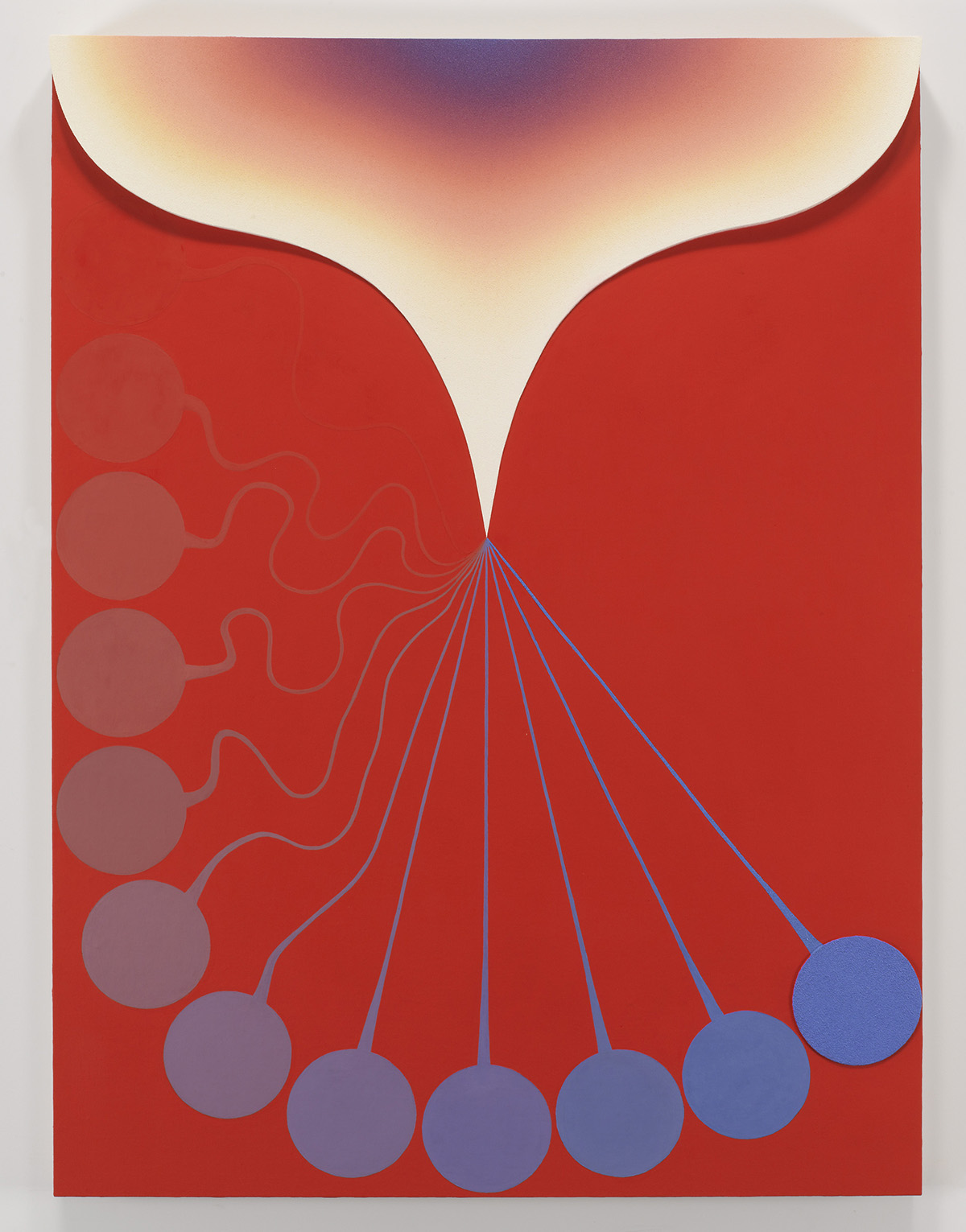

The number of ultra-high-net-worth individuals in the Philippines is forecast to grow at the the second fastest rate of any country, says Knight Frank’s Wealth Report 2019. Pictured here: Manila

Lord Andrew Hay. Image by John Wright

Lord Andrew Hay is Global Head of Residential at Knight Frank, the international real estate consultancy, and has built up property portfolios for some of the wealthiest people in the world. In this regular column, he is handed a theoretical sum of money by LUX and asked how he would invest it. This month, we asked Lord Hay where he would invest if he had $200m to spend on real estate in emerging markets

“Where would you invest if you had $200m to spend on real estate in emerging markets?” It seemed appropriate that I was asked this question by LUX having just returned from a business trip to Manila. With the Philippines front of mind – this is where I would start.

Follow LUX on Instagram: luxthemagazine

As reported in The Wealth Report 2019, the number of ultra-high-net-worth individuals (UHNWIs) in the Philippines is forecast to grow by 38% in the five years to 2023, the second fastest of any country. In Manila, the Business Processing Outsourcing (BPO) facilities sector is rapidly growing – currently employing 1.5m Filipinos, 1.5% of the population, and accounting for 7.5% of the economy – with the government aiming to expand this to 10-11% in 2020. This growth has boosted office rents within the metro Manila region as well as the residential market as investors snap up multiple units to lease out to BPO employees working nearby.

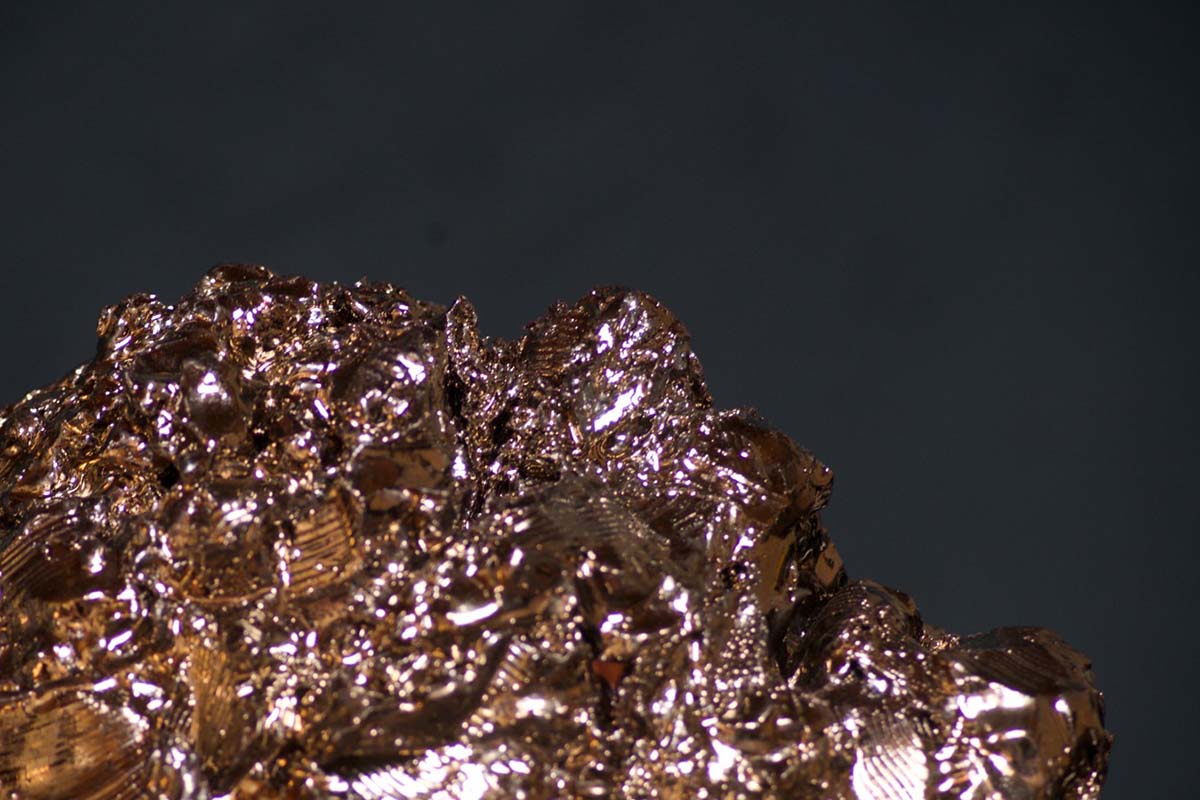

I would then move my attention to India. Recently the Government of India has put in place a growing number of incentives to enter India’s warehousing sector and this is an area, which seems ripe for investment. The new ‘Make in India’ programme was created to encourage manufacturing; the development of multimodal transport networks and the setting up industrial corridors such as The Delhi Mumbai Industrial Corridor (DMIC) are also supporting growth in the market.

India’s warehousing sector is ripe for investment, according to Knight Frank’s Andrew Hay. Pictured here: Mumbai

My focus would then turn to an investment in South Africa and to something that appeals to me on a more personal level – a game lodge and reservation. As interest in climate change, sustainable tourism and the concept of “natural capital” grows around the world, there is an increasing focus on Africa. Much of this is centred on South Africa and projects that can add significant value to denuded agricultural land, especially if the “Big 5” are in residence.

Read more: Why we love the Richard Mille x Roberto Mancini RM 11-04 timepiece

Back to Asia, I would look to South Korea. The government recently introduced a pre-sale price cap policy in an effort to cool its housing market. However, this currently only applies to four areas in Seoul. House prices in certain prime areas of the city have been recording price growth in excess of 15% year-on-year over the last 12-18 months, as developers rushed to redevelop older buildings. Going forward, this move is expected to rapidly cool speculation in the market and reign in accelerating prices but there is still an opportunity to invest here.

There are no restrictions on foreign nationals acquiring property in Romania, making entry into the market easier for investors, says Andrew Hay

I would then consider closer to home in Europe – the Romanian prime residential market. It recorded promising results in the first half of 2019 and, according to Knight Frank, 60% of developers active in the local market expect price increases of up to 10% per square metre in the next year. There are no restrictions on foreign nationals acquiring property in Romania either, making entry into the market easier for investors than many other markets.

Perhaps not the most glamorous of locations or assets but nonetheless a diverse and interesting portfolio and this is where I would invest $200m if considering investment across some of the world’s emerging markets.

Find out more: knightfrank.co.uk

Recent Comments