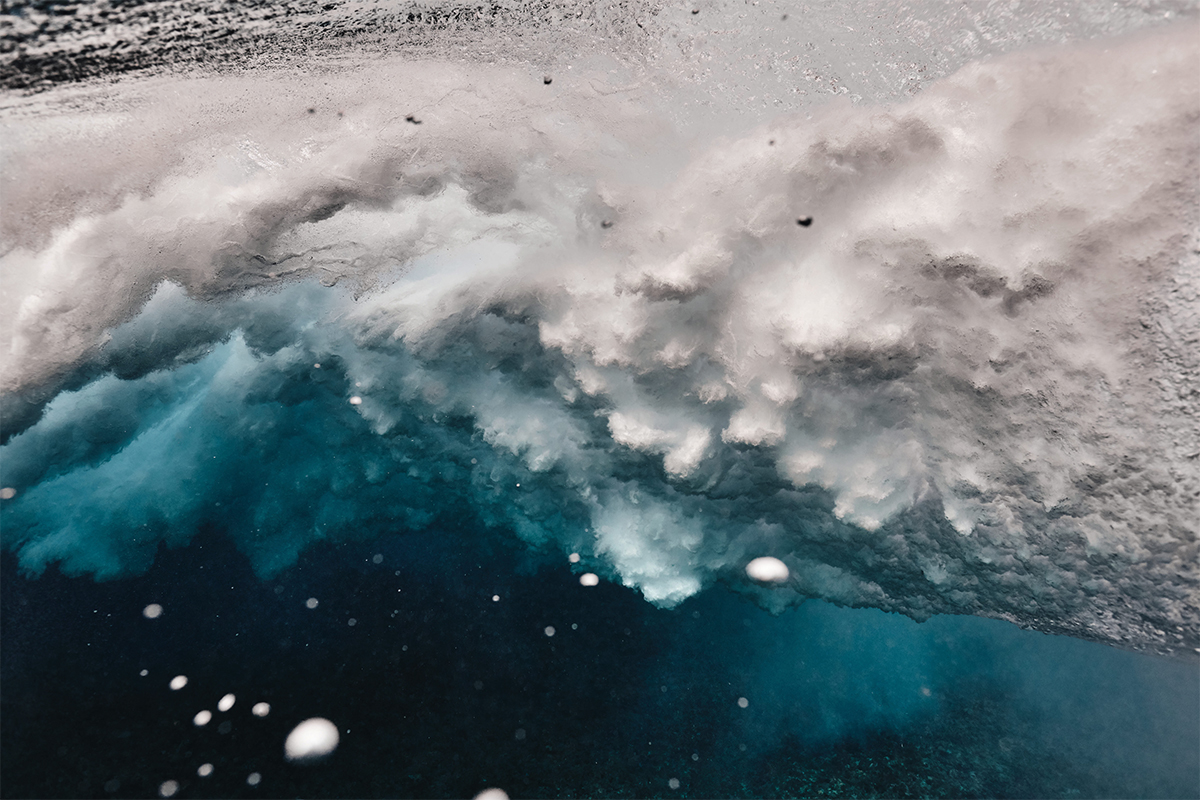

Image by Ben Thouard

With Ocean Week upon us, LUX speaks to Karen Sack, a leading voice in the ocean economy, about how only action and investment from the Global North can allay the effects of global warming on the world economy – and its most valued nations

Karen Sack

LUX: What is the fault line between the Global North and the Global South?

Karen Sack: If we look at the world from an ocean perspective, the most biodiverse areas today are in the developing world. They are around the coasts of developing country waters, and, in particular, the waters of Small Island Developing States (SIDS). These are also the countries that have created the most Marine Protected Areas (MPAs). So there is a stress between these countries and those that support other activities, such as subsidising vessels that exploit distant waters, going to faraway places and fishing in destructive ways.

LUX: What about the societal effects of climate change?

KS: This is a growing concern for developed countries, as they see the impact of climate change through the migration of people who are leaving these vulnerable coastal developing states and SIDS. These people are at risk because their livelihoods are compromised – there are no more fish to catch. They move to cities, but the cities don’t have the infrastructure to support them. This leads to international migrations, as we see with Central America up to North America, Africa into Europe, and in Asia, too. Suddenly, these issues are beginning to have international implications. It will be far more cost-effective for developed countries to invest in coastal and ocean resilience in developing countries and SIDS, than to leave it and have to deal with the consequences of the climate crisis.

LUX: How can this investment be driven?

KS: The issue of broader investment is where we at Ocean Risk and Resilience Action Alliance (ORRAA) are focused. There is a huge challenge in driving investment towards a sustainable blue economy into these countries of the Global South. Transactions are often too small for private-sector companies, and there’s risk because of the credit status of the countries or because of climate events. So we’re not seeing the investment that’s needed to help fundamentally shift the way developing countries are able to work. For example, many SIDS in the Pacific have to sell their fishing resources to foreign fleets so they can earn foreign-exchange dollars to pay for diesel fuel, so they can power their economies.

Follow LUX on Instagram: luxthemagazine

There’s this constant vicious cycle, and there are huge emissions, both transport emissions and direct emissions from burning fuel. If we shift all those islands to renewable energy, we break existing dependencies, and it doesn’t cost that much money. One Pacific island estimated it will cost $180 million to shift completely to renewables. They cannot find the money because they don’t have the credit rating and they don’t have the in-house resources. You have to break all those cycles to work forward quickly, and I hope that’s what we can do through ORRAA. As a multi-stakeholder alliance, with multilateral banks, private banks and insurers on board with us, as well as civil society, academics and countries themselves, we can get people around the table to solve problems. We can help develop de-risking mechanisms, such as insurance or public-sector guarantees, to incentivise private-sector banks to invest into countries, which could help reduce or eliminate their dependence on fossil fuels.

LUX: Do we in the media have a role to play?

KS: Of course. We all work in silos, where we don’t join the dots between our functions. So we need to join the dots and think about how important it is to shift to renewables from fossil fuels, how that helps to build resilience, and how that incentivises investment and credit ratings, building biodiversity-positive outcomes and climate resilience for 250 million climate- vulnerable people. We must change our mindsets.

LUX: Is government regulation required?

KS: Government action is essential, but for the private sector to wait for that is not in its long- term self-interest. We need to see action now. For example, in the US, the development of a natural-capital accounting methodology is being worked on, so businesses can account for their impacts on natural capital and disclose those impacts, and then investors can think about what that means for investment portfolios. The same is happening in France and China.

LUX: What needs to happen next?

KS: First, we need to get some of the largest banks and asset managers to sit down with the multilateral banks and organisations like the US government’s Development Finance Corporation (DFC), and talk about what is key for them in terms of de-risking their investments. Is it a guarantee, business- interruption insurance or another mechanism? The multilateral banks need to step up and provide those mechanisms, so we can crowd more financing into these sectors. The second thing is building capacity in these countries to enable the establishment of laws and regulations that will create a stable investment environment, so that these types of financing mechanisms can emerge. The third ingredient is for the private sector to recognise that we need to finance the “missing middle” – investments from $2 million to $10 million in small island countries where entrepreneurs are doing all they can to build sustainability, but cannot move from seed funding into product development or into the next stage of evolution of their companies.

LUX: Aren’t the interests of, say, the Maldives different to Brazil’s?

KS: When we speak about Least Developed Countries and SIDS, I think they speak with one voice. They are all looking for these types of opportunities. When we look at countries further up the development chain, such as Brazil, South Africa, Indonesia, there are different incentives. However, entrepreneurs in those countries have the same challenges, and that is something we need to focus on.

Read more: Markus Müller on the links between the ocean and the economy

LUX: What can happen this year?

KS: There’s a major opportunity, given the change in leadership at the World Bank, to focus on the biggest challenges facing the Global South, and there is no question that the two biggest challenges are the climate crisis and the biodiversity crisis, both underlined by the unsustainable debt crisis. The private sector also needs to focus on investing in sustainable blue- economy opportunities – feeding that missing middle. At ORRAA, we’re working with some of our partners to develop a fund to deploy $150 million into investable opportunities in developing countries to build that sustainable blue economy. The third piece is we have to think outside the box to finance the landmark Global Biodiversity Framework agreed at COP15 in Montreal in December 2022. How do we protect 30 per cent of the planet by 2030? What kind of finances can be mobilised to do that, so that countries are not going into debt to build back biodiversity? We have to break the log jam around the climate-finance issue in terms of loss and damage. And we have to do it now.

Karen Sack is Executive Director of Ocean Risk and Resilience Action Alliance (ORRAA). She was speaking to Darius Sanai

This article was first published in the Deustche Bank Supplement in the Spring/Summer 2023 issue of LUX

Recent Comments