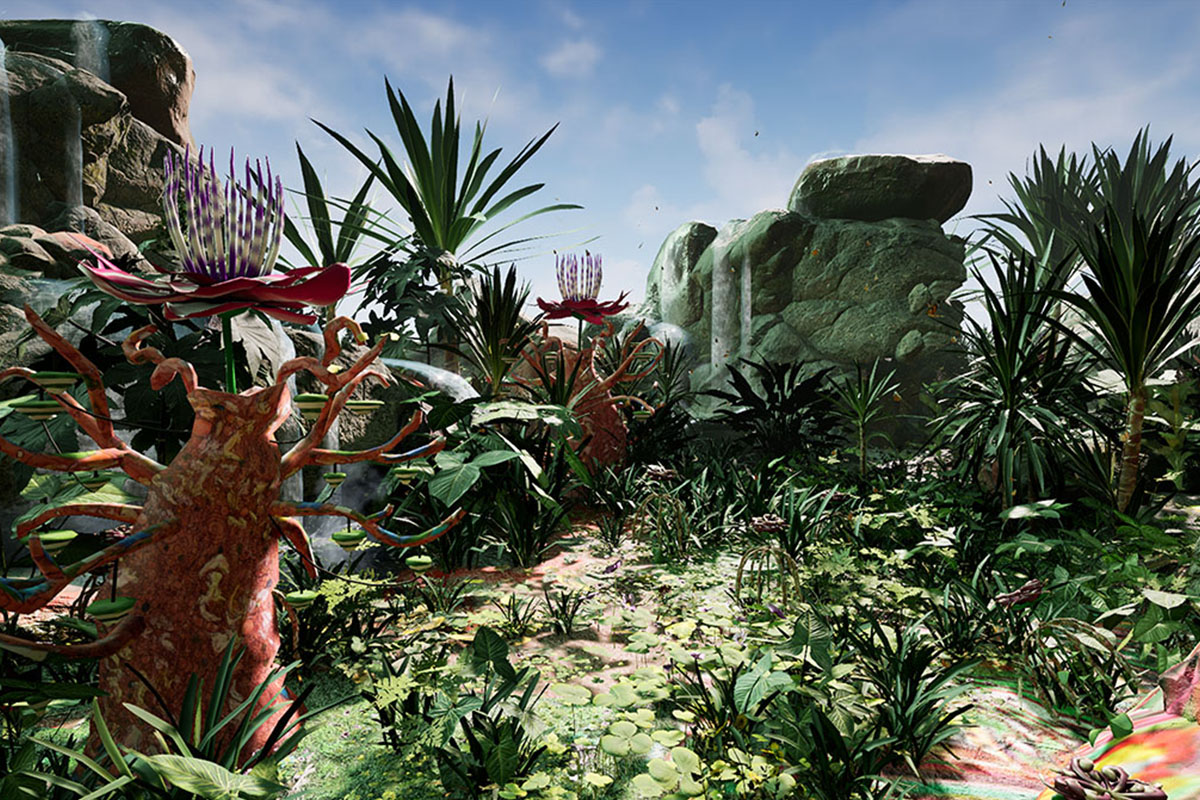

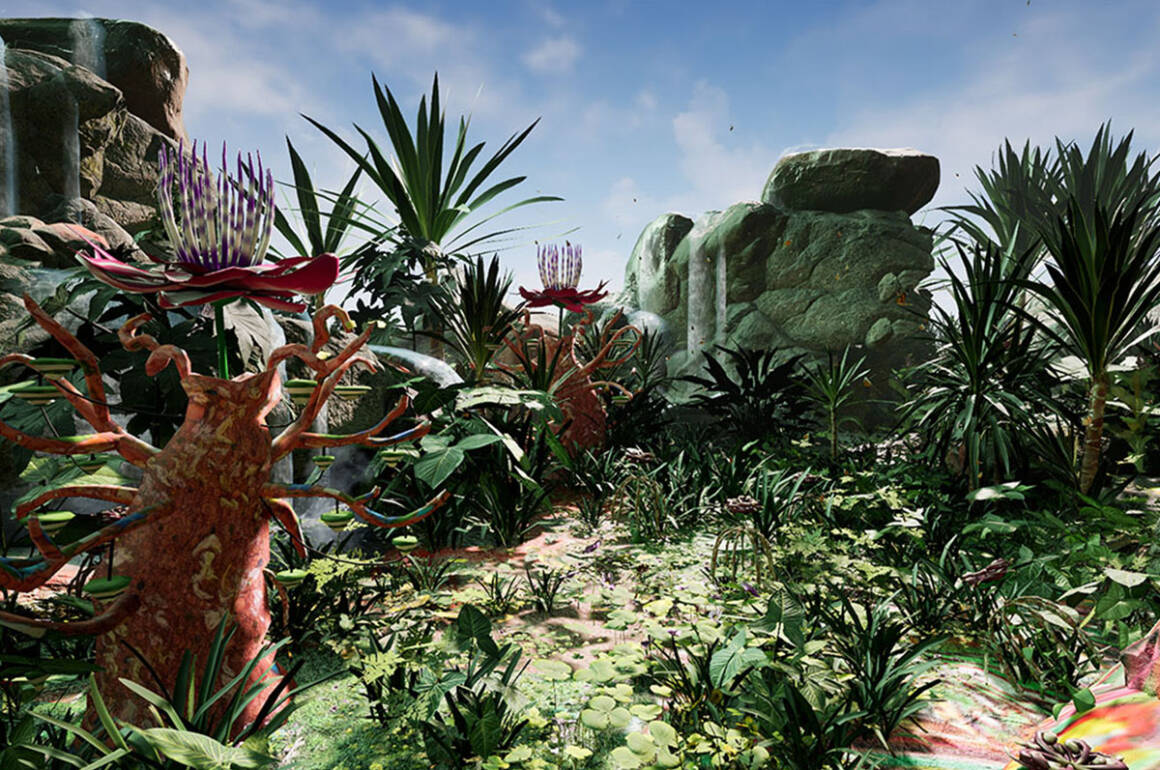

Shezad Dawood, Night in the Garden of Love, 2023. VR environment, duration variable, produced by UBIK Productions, co-commissioned by WIELS, Brussels and Aga Khan Museum, Toronto. Courtesy of UBIK Productions

British artist Shezad Dawood is presenting his latest exhibition ‘Night in the Garden of Love’ at WIELS in Brussels this May. Commissioned by WIELS and the Aga Khan Museum, this exhibition marks Dawood’s largest presentation of new work since 2019 and his first solo exhibition in Belgium

Shezad Dawood is known for his experimentation across numerous different disciplines and exploration of different cultures. Inspired by the works of musician Yusef Lateef, ‘Night in the Garden of Love’ showcases a captivating blend of music, drawings, virtual reality experiences, painted textiles, algorithmic plants, costume-sculptures, and live choreography.

Follow LUX on Instagram: luxthemagazine

He first came across Lateef’s music in his youth, and later became fascinated by his abstract drawings which often feature dreamlike landscapes and strange but beautiful life forms inspired by music pieces. Dawood’s latest exhibition, however, is based on Lateef’s novella, from which it takes its title.

Shezad Dawood, Night in the Garden of Love, 2023. Performance rehearsal, Choreographer and Dancer, Wan-Lun Yu. Costume by Ahluwalia. Image by Miranda Sharp. Courtesy of UBIK Productions

Lateef pioneered a methodology he called Autophysiopsychic music, which he defined as “music from one’s physical, mental and spiritual self”. Like Dawood, he integrated cultures and traditions from across the world into his artwork and experimented across many different mediums. The exhibition serves as a dialogue between Dawood’s practice and Lateef’s, and through it, Dawood aims to create a metaphysical and virtual space, leveraging technology to imagine new forms of togetherness while also addressing the climate crisis.

Installation view ‘Shezad Dawood, Night in the Garden of Love’, WIELS, Brussels, 2023 © We Document Art

On wide variety of mediums featured in the show, Dawood told LUX: “It took me almost 8 years to bring this project to fruition, and one of the key aspects for me was the set of correspondences and echoes between Lateef’s music, his drawings and his writing practices, which I began to see as one expansive score.

Installation view ‘Shezad Dawood, Night in the Garden of Love’, WIELS, Brussels, 2023 © We Document Art

This allowed me to build the show as an iterative score, where each element leads to the next and informs and amplifies it, like stars in a constellation.

Read more: Vik Muniz’s Mixed-Media Reflection on Perception and Materiality

When I paint I often think of colour in terms of a palette of sound and music, and then elements from my paintings informed the digital seedbanks, as I derived the base designs for each algorithmically generated plant from my paintings, that were in turn responding to Lateef’s original drawings, which also feature in the show.”

‘Night in the Garden of Love’ is running until Sunday 13th August at WEILS in Belgium

This article was published in association with the Durjoy Bangladesh Foundation

Recent Comments