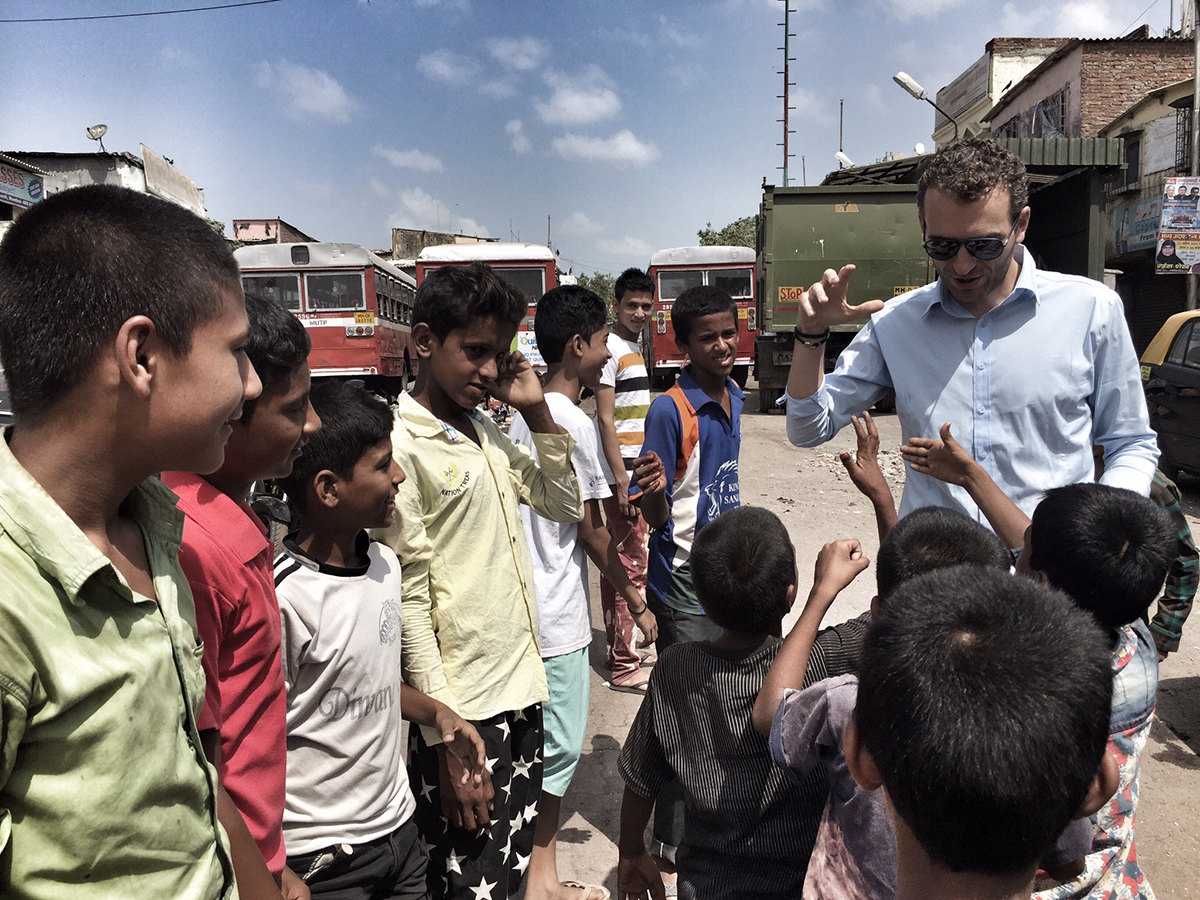

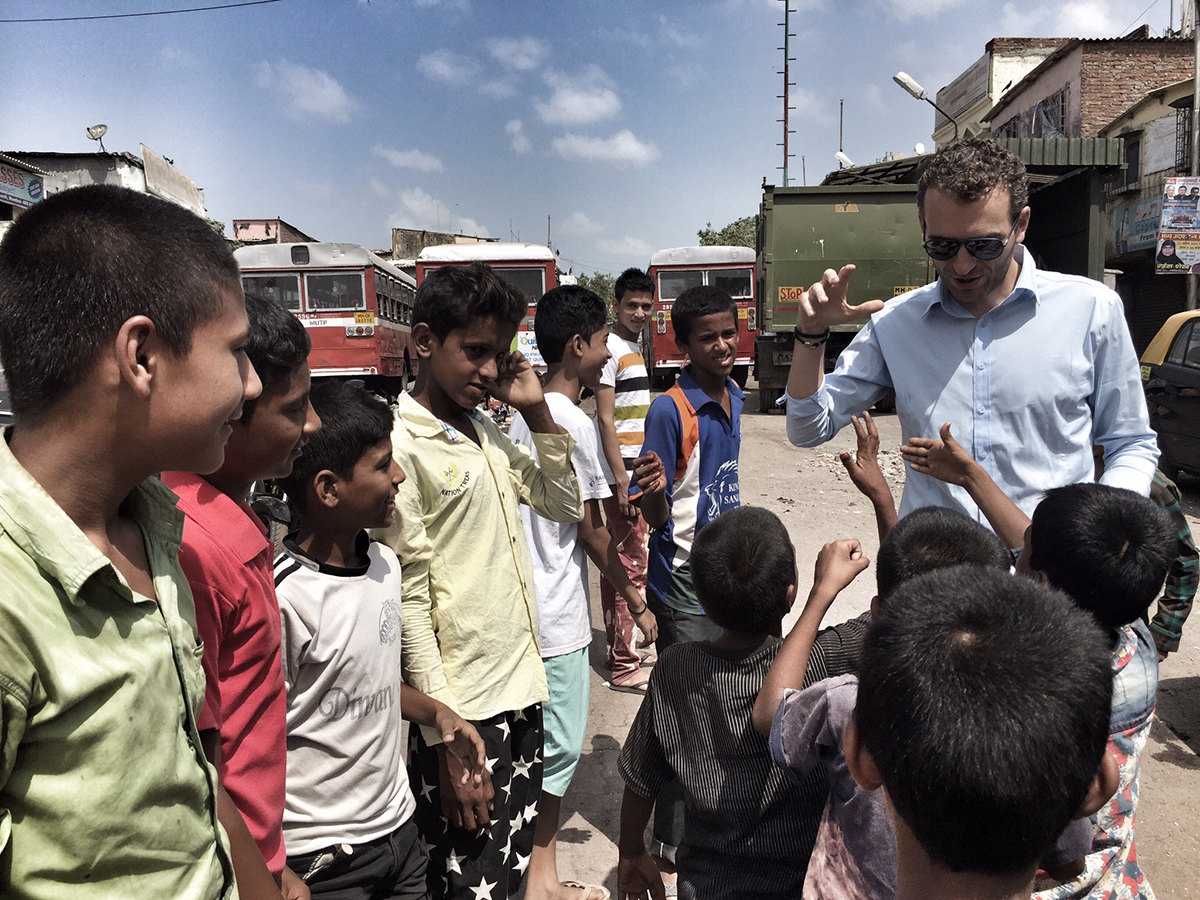

Alexandre Mars is the Founder & CEO of non-profit foundation Epic and the Founder of Paris-based VC fund blisce/. Image courtesy of Epic

French entrepreneur, author and philanthropist Alexandre Mars founded nonprofit organisation Epic in 2014 to help change the lives of disadvantaged young people around the world through individual and corporate donors as well as partnerships with other social organisations. As part of our ongoing philanthropy series, he speaks to Samantha Welsh about the importance of encouraging people to give more often, building a strong team and putting in the hours to achieve success

LUX: When did you start your first business and what made you do it?

Alexandre Mars: I started my first business at 17 years old by organising concerts at my high school. While I didn’t have the natural ability to become a professional athlete or movie star, something about entrepreneurship resonated with me.

The goal was never just to make money. It was about what to do with that money – a means to an end. Growing up with a mother that instilled values of altruism and solidarity in me from a young age, I knew that I wanted to give myself the necessary resources to protect my loved ones and then help others in need around the world. This first business was a first step toward realising that mission. I earned enough money to buy my first computers and that’s how my career as a tech entrepreneur was born.

Follow LUX on Instagram: luxthemagazine

LUX: Why did you pivot from serial entrepreneur to successful philanthropist?

Alexandre Mars: I’d actually consider that it was more of a continuation than a pivot. As I mentioned before, it was always my goal to help those less fortunate. It just took me a bit longer than expected to generate the means of being able to do so on the scale I hoped.

When I was ready to create Epic, my foundation, I still came at it from a very entrepreneurial perspective. In fact, a close friend of mine asked me an essential question as I embarked on this new venture: ‘What’s your uniqueness?’ In other words, how could I help others in ways that someone else couldn’t. Entrepreneurship is what I know best, so I built Epic like my previous startups, methodically and always with market needs in mind.

Working with young people can make for the most measurable outcomes. We know empirically that intervening early on is the most effective way to change life trajectories. That’s why we’ve decided to specialise in helping children and young people aged 0 to 29 years old.

Disadvantaged youths can come from anywhere, whether it be halfway across the world or in our own neighbourhoods. While the specific issues may vary from physical safety and job prospects to education and healthcare access, the overarching injustice remains the same: no one should be denied the opportunity to live their life to its full potential just because of the circumstances of their birth.

Alexandre Mars in Mumbai. Image courtesy of Epic

LUX: Tell us about Epic.

Alexandre Mars: Epic is the culmination of deep market research into the philanthropic sector and the solution to three major obstacles to charitable giving: lack of knowledge (about who to give to), lack of trust (that the funds would be put to good use) and lack of time (to do the necessary research).

Our vision is a world in which every child and youth has access to safety, empowerment and equal opportunity. Our mission is to find, select, back and monitor high impact charitable organisations in order to catalyse their impact on underserved children and youth, and the systems affecting their lives. We are able to effectively fund them thanks to our donors who pool their resources together via our platform.

There are currently 26 organisations in the Epic portfolio worldwide, working on essential issues like access to healthcare, employment, education and physical safety. To date, we have raised $30 million.

What sets Epic apart is the robustness of our methodology that promotes transparency and accountability. From the outset, Epic has had a rigorous selection process to ensure trust and confidence. We curate a portfolio of high-impact, mid-size organisations addressing the complexity of issues affecting children and youth in a select number of countries, through a thorough and cutting-edge sourcing, vetting and monitoring process.

Another important factor is timing. We intervene at a stage in these organisations’ development when our support is the most transformative, allowing them to scale and have an even greater impact on children and youth.

Read more: Alia Al-Senussi on art as a catalyst for change

LUX: You are the enfant terrible disrupting traditional philanthropy, yet you build great teams. How do you go about that?

Alexandre Mars: Whether at Epic or any other startup I’ve founded, an undeniable key to success has been building the right team. And it starts with humility: you need to evaluate your strengths as well as your weaknesses, and hire for those needs.

For example, I built my career in the tech space, but I don’t know how to code. I surrounded myself with talented, passionate people. But it’s not enough to hire them. You need to have trust and give them autonomy to do their best work. It sounds like a simple formula, but it really works.

LUX: What issues around methodology come up most frequently in conversations between your NGOs?

Alexandre Mars: One of the interesting things that comes up often is how we measure success. We have been working hand in hand with our portfolio organisations to define a specific set of KPIs that they report on and that are tailored to their issues areas and strategy, for example: academic success rates or job placements. It’s a very interesting data-driven process that enables Epic to understand organisations’ performance in the context of their own success metrics as well as in the context of our centrally defined framework.

LUX: You have ‘skin in the game’ and pay all operating administration costs yourself – what are your expectations of companies and individuals who give and outsource to Epic?

Alexandre Mars: Two words: involvement and trust. We make sure that donors are very engaged throughout the giving process and that they’re able to follow their impact. Thanks to our thorough monitoring that brings accountability, our donors are more likely to continue giving. It’s a virtuous circle. This relationship of mutual confidence keeps our donors coming back year after year.

I also ask our donors to move away from certain outdated views on philanthropy, and to understand that impact and success cannot always be boiled down into quantitative terms like the number of children served per euro spent. Our organisations are dealing with a complex set of issues, and change takes time, as well as precise methods of measuring and understanding those outcomes. But you are right, I do have a lot of skin in the game so that 100% of all donations are sure to go directly toward changing lives.

Image courtesy of Broadsoft

LUX: How has your approach guided your selection of partners in diverse regions and cultures?

Alexandre Mars: Our methodology takes into account 45 criteria in three categories: governance, impact and operations. It was developed by our team that draws on experience from both the non-profit and private sectors. For example, we’ve integrated best practices from the venture capital sector and evaluate organisations as if we were investing in a tech startup, looking at factors like growth potential, the quality of the leadership and most importantly, the organisation’s ability to create changes in the lives of the children and young people they serve.

The principles of our selection process drive at an understanding of how an organisation fares against an objective set of criteria. By looking through the lens of each organisation’s internal and external contexts, we are able to look at a worldwide set of organisations operating on vastly different issues and across varying social, financial, operational contexts. Interestingly, we do observe a certain universality, to an extent, in these organisations’ frameworks.

LUX: What corporate structures are most open to outsourcing their philanthropy to optimise returns?

Alexandre Mars: We work with corporates, but also foundations and individuals. One of the most frequent reasons they choose Epic is because we address three major obstacles in charitable giving: lack of trust, time, and resources. This is especially true when it comes to funding organisations that are in other countries than where the donor is located. We are a sort of one-stop-shop that they can trust.

Furthermore, I believe that people go through Epic to support children and youth because they have confidence in our model that focuses on strategic philanthropy. We look for impact and have developed a cutting-edge selection and monitoring methodology to ensure a certain return on investment, to borrow a term from the business world. It’s quite innovative, which explains why Harvard University did a case study on the Epic model in 2019.

Read more: Michelin-starred high altitude dining in Andermatt

LUX: To the average person, charities want to get more people to give, whereas you want people to give more often. Why?

Alexandre Mars: Our experience has shown that charitable organisations benefit from having a stable source of funding, rather than volatile ups and downs throughout the year. It allows them to more effectively plan and allocate resources to those they serve. That’s why our model is centred on multi-year unrestricted funding, giving organisations the stability and autonomy to do what they do best. We encourage companies and individuals to make giving a habitual action and embed the social good in a way that fits seamlessly with their personal situation or business model.

The form this solidarity takes will vary from case to case. For example, we’ve worked with Société Générale on a simple yet innovative solution that allows the bank’s corporate clients to round-up foreign exchange transactions and donate to Epic. And for entrepreneurs, we created the Epic Pledge whereby they commit to donating a percentage from the future sale of their company.

You are mission-driven, so how do you control social media to deliver success?

LUX: How does blisce/ fit into your current vision?

Alexandre Mars: At my growth stage venture capital fund, blisce/, we support mission-driven entrepreneurs to build global consumer technology companies like Spotify, Pinterest, Headspace and Too Good To Go. So we’re approaching social impact from another angle, but it’s absolutely core to our collective vision.

Finance can be a powerful tool and, if yielded responsibly, can be a force for good. That’s why we’re committed to working with our portfolio companies to improve their (and our own) environmental, social and corporate governance measures. For example, our term sheet includes two non-negotiable clauses for ventures: an agreement to carry out an ongoing ESG evaluation every 12-18 months, as well as a commitment to interview at least one diverse profile for every open senior leadership position. Our team has committed to donating 20% of its carried interest revenues to Epic, so it’s really a virtuous circle between my investment and philanthropic activities.

As a testament to these engagements, we’re very proud that blisce/ recently became the first B Corp certified growth stage VC fund in the E.U.

LUX: How has this vision developed and what projects are you looking forward to over the medium term?

Alexandre Mars: It is my view that solidarity and sharing are going to become increasingly essential, and that we can no longer rely solely on public support if we are to address the challenges we face such as rising inequality, climate change, lack of diversity, gender inequality. We need the participation of the private sector and an engaged citizenry as well.

In the near term, we will be doubling down on our strategies at Epic and at blisce/ to identify and support exceptional social organisations and mission-driven companies that positively contribute to our communities and planet. I’m thrilled by all of the determined social entrepreneurs I meet on a daily basis, and look forward to announcing those that we’ll be backing soon.

LUX: Has Covid accelerated how you do things?

Alexandre Mars: In my opinion, Covid has accelerated a trend that has been building for the past several years. I’m old enough to remember how different the world was just 20 years ago. People viewed success differently: it was about the number of zeros in your bank account, about having a corner office and a company car. Today that’s all changed, especially with the arrival of the millennials and Gen Z. Today, we know that real fulfilment and purpose comes when you put that material success toward realising your mission, whatever it may be.

Covid has only reinforced this evolution, as it has given many of us time to pause and reflect while also exposing the ever-widening rifts in our societies. So in terms of how it’s changed things for us at Epic and blisce/, I can’t recall a time when we’ve seen such an outpouring of support from across the board, or so many entrepreneurs for whom combining purpose and performance is an automatic must-have. It gives me reason to believe in the work we’ve been doing and to be optimistic about the future.

Image by T.G. Herrington

LUX: What lesson did you learn with a start-up as a teenager that you will share with your own kids?

Alexandre Mars: Entrepreneurship, including my first venture, has taught me so many lessons over the years. That’s part of the reason I wanted to write my recent book on the subject (it’s out in French now under the title OSE ! Tout le monde peut devenir entrepreneur, and the English translation is coming soon).

If I had to pick just one piece of advice, I’d emphasise the importance and necessity of hard work. Luck and natural ability only account for a small fraction of success. What will set you apart is outworking the competition, which will inevitably require sacrificing other activities such as going to the movies, coffee breaks, and weekends with friends. You won’t be able to do everything and work hard at the same time. That’s the harsh reality of it.

In my book I talk about Canadian journalist Malcolm Gladwell and the 10,000 hour theory he popularised. He explains how, in any discipline, 10,000 hours of practice is required to achieve the level of world-class mastery. This theory is based on the experience of three psychologists in observing violin students at the prestigious Berlin Academy of Music. The results were surprising: future international maestros each had reached 10,000 hours of practice; good violinists reached 8,000 hours, and future music teachers did not exceed 4,000 hours.

To take another example: when the Beatles were successful in 1964, supposedly coming out of nowhere and taking the world by storm, in reality they had exceeded 12,000 hours of rehearsals and concerts. They didn’t just appear overnight.

And as a last piece of related advice, I always remind my children about the importance of having a mission. In the end, having a sense of purpose is what brings true satisfaction, plus it will sustain you on your arduous but rewarding entrepreneurial journey. When you wake up in the morning with something bigger than yourself on your mind, you’ll find the motivation you need to succeed.

Find out more: epic.foundation

Samantha Welsh is a contributing editor of LUX with a special focus on philanthropy.

Recent Comments