Can we put a price tag on nature? Valuing the carbon services of plants and animals is essential to bridging the gap between finance and conservation, says Professor Connel Fullenkamp, the leading academic working at the intersection of science and economics. Here, Fullenkamp speaks to LUX about the importance of engaging capital markets in biodiversity financing, and why necessity is the mother of invention

Can we put a price tag on nature? Valuing the carbon services of plants and animals is essential to bridging the gap between finance and conservation, says Professor Connel Fullenkamp, the leading academic working at the intersection of science and economics. Here, Fullenkamp speaks to LUX about the importance of engaging capital markets in biodiversity financing, and why necessity is the mother of invention

Professor Connel Fullenkamp

LUX: You have spoken profoundly about the value of natural assets.

CF: We’re bringing economics, finance, and business into an area where it really hasn’t been brought in before. We start with the approach that says these natural assets have a lot of value, but we don’t necessarily know how to put a price tag on that value. So, we start only with the things that we can find a market price for. This is because we want to speak the same language as investors and policymakers who have to keep their eye on the bottom line all the time.

When we go out and try to put a value on a natural asset, be it an elephant or a mangrove forest, we’re really thinking about this as trying to attach the lowest, believable value. We’re trying to convince people that the value is way more than that. That has got a lot of people’s attention, because it acquaints them with the tremendous value that resides in many natural assets.

LUX: Can there be a system that’s devised for transferring payments? For example, if a company destroys a coastal mangrove plantation, who does it pay for that lost value?

CF: Part of the desire behind this is to prevent the destruction from happening in the first place. But we’re living in a world in which we already have those kinds of swaps going on. So, what we’re trying to do is put an adequate value on that. We are also trying to create the impression that the contributions to things like biodiversity are worth even more. In many cases, of course, it’s the government that owns these assets, so we have to inform them what they are worth.

Follow LUX on Instagram: luxthemagazine

For example, we were approached by the UK Environment Agency to help them value their salt marshes, given that they have diminished by 90% in the last century or so. If we can put a price tag on these things, we can help governments make the argument that, firstly, you shouldn’t destroy these things in the first place, and secondly, if you do harm these assets, there’s going to be a steep price to pay.

LUX: How hard is it to find a valuation when there are so many different factors? For example, with a salt marsh, you have to incorporate the carbon storage or the flood protection, and then the ecosystem’s biodiversity.

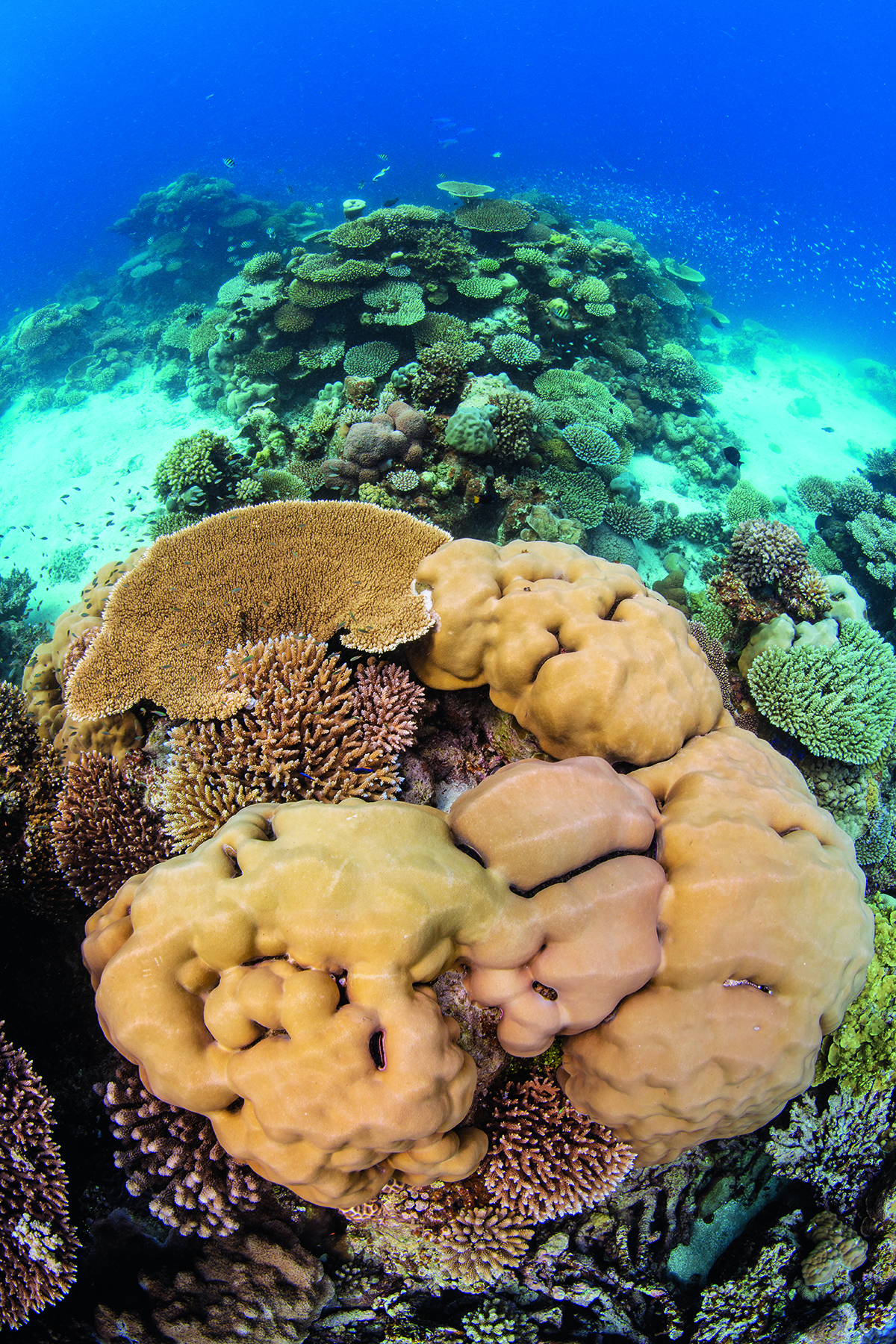

CF: It’s difficult to put a total valuation on most of these natural assets because it has proven to be difficult to value something like the contribution to biodiversity. It’s hard to even define what biodiversity is. Biodiversity in a desert is very different to that 1,000 or more kilometres south in rainforests.

LUX: What opportunities are there in terms of constructing a financial pathway for investors?

CF: This is something we’re very keen to create. Ideally, we’d have investors who are interested in investing in natural capital services, such as carbon sequestration, because there’s a fairly well-established market for it. These investors would like to purchase either carbon offsets or have other reasons for wanting to hold carbon credits. They would pay for certificates that would deliver the carbon credits, and then the proceeds would function like a sovereign wealth fund.

Read more: Professor Nathalie Seddon On Biodiversity And Climate Resilience

Hopefully, the main use of that money would be, of course, to establish conservation restoration programmes. This is a long pathway between the financial markets all the way to the people on the ground doing conservation restoration. But unless we create that pathway, I think we’re missing out on a huge opportunity.

LUX: Which opportunities should investors be looking towards, in terms of creating the new financial system to support this?

CF: There are two things that should create excitement. They’d be investing on the idea that these are natural resources will continue to deliver these different environmental services, like carbon sequestration. We’re betting on the recovery of those things. Also, they’re betting on the plus in which carbon will help us understand what the biodiversity benefits are, that can also then be priced. If we get good at establishing these carbon markets, we kind of wrap in these biodiversity services as a plus.

LUX: What are the main hurdles to be overcome?

CF: Governments are very reluctant to think about selling their natural assets to the private sector. And so, our first hurdle is to convince them that, no, you’re not selling the assets. We’re trying to get you to sell the services of the natural assets; in fact, governments need to retain ownership of these assets.

We have to establish a conduit that will help governments protect these assets so that they can continue to generate services and support: mainly the beauty and culture of their countries. Governments are naturally reluctant because this is a brand new thing that they’ve never seen before. The markets are sceptical for similar reasons, and because there are some less-savoury actors out there who’ve already been trying and failing with certain initiatives.

Also, there is, especially in the case of wild animals, scientific uncertainty. So many of these species are facing near extinction across the board. We don’t have time. We need people to say, okay, the science is good enough. We’re willing to believe in it and bet on it.

LUX: Are these outcomes possible?

CF: I’m optimistic. The reaction we get when we talk to people has been overwhelmingly positive. When you get the capital markets involved, you can unleash a tremendous amount of financing that can do a lot of good, hopefully for conservation and restoration.

It is hard to imagine being able to cover that biodiversity financing gap without the participation of the financial markets. So, one of the things that drives my optimism is the fact that necessity is the mother of invention. For addressing climate change, this is one of our best chances. The trick is to put everybody together and get them to work together toward this common goal.

LUX: Will there be developments in attaching more specific prices, in terms of the science around biodiversity and nature-based capital?

CF: Absolutely. I think there’s a lot of excitement in that research. In particular, for example, one of the leading seagrass researchers is very excited about our work and is writing a paper for us. Seagrass is again one of these unsung heroes of blue carbon that sequesters a tremendous amount of carbon. We still don’t know what the full extent of seagrass coverage is anywhere, because nobody’s really had the money or the gumption to go look for it. So just finding out where the seagrass is, how much it covered it can sequester and where it can be restored: those kinds of issues are the type of research that we see coming out of this in the short term.

LUX: Are there accessible ways of investing in natural capital in the way that you’ve outlined?

CF: What we’ve got in mind is a bit different from, say, the sustainability linked bonds or green bonds that we see out there. There again, I think these are they’re all great and part of the solution here. But really, when you’re investing in something like a sustainability linked or a green bond, you’re basically a bond investor. You’re hoping that the money gets put to a certain type of a purpose. And in some cases, you’re going to get some either yield pick up or yield penalty depending on the performance. But really, you’re not making a direct investment, so to speak, or a direct bet on the actual natural capital itself. You’re really not investing in environmental services. That’s to me, in my mind, that’s a really big difference here, that what we’re what we have in mind and what we’re trying to create is really an asset backed market. And the asset that is being used to back the market is the natural capital services.

Read more: Dimitri Zenghelis on Investing in the Green Transition

LUX: In an optimistic scenario, how do you see this looking in 10 years’ time with the landscape?

CF: This will be just another asset class that people have available to them to invest in and it will have certain properties. Hopefully it will be sufficiently uncorrelated with other types of market returns to make it attractive as a diversification tool, if not for its own sake, and what it represents in terms of investment in the environment. So ideally, that’s what we’d see people would say. Well, I’ve got some of my portfolio in stocks and bonds, real estate alternatives. And one of the alternatives is going to be these natural capital assets.

Connel Fullenkamp is Professor of the Practice and Director of Undergraduate Studies in the Department of Economics at Duke University

Find out more: duke.edu